National ACORN Leaders

Alejandra Ruiz Vargas

ACORN Canada President

Alejandra is a housing worker originally from Colombia who has been involved with ACORN since 2015. She has led meetings and actions on issues such as. childcare, remittances, and employment insurance reform but her passion and advocacy on affordable housing, tenant rights and state of good repair issues is her passion.

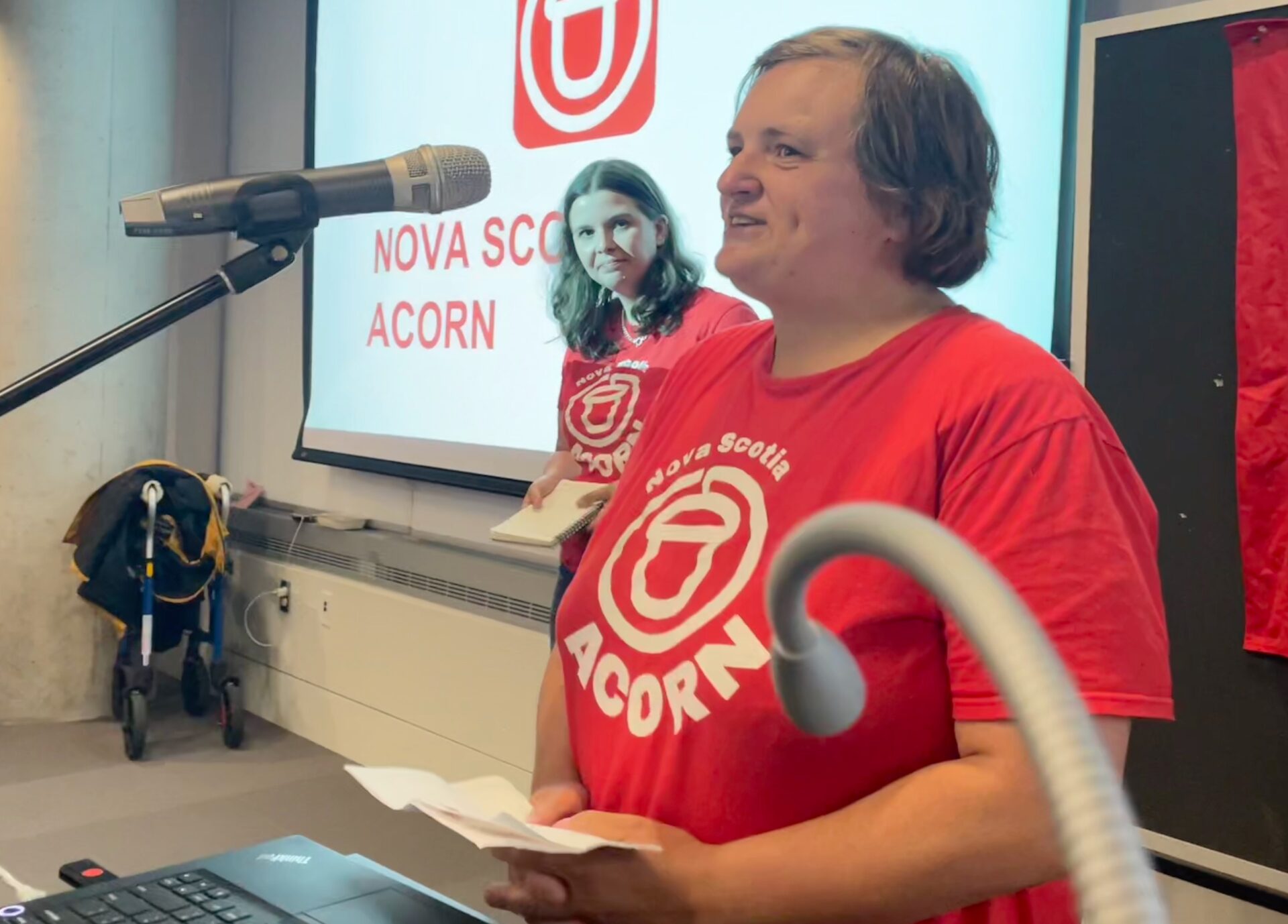

Lisa Hayhurst

ACORN Canada Secretary

Lisa brings her experience helping lead Nova Scotia ACORN’s successful Rent Control Now campaign to the ACORN Canada national board, where she sits as a Nova Scotia rep. Lisa is currently focussed on winning a landlord licensing system in the Halifax Regional Municipality and being a thorn in the side of her negligent landlord.

Monica Bhandari

ACORN Canada Secretary

Monica was elected Chair of New West ACORN and sits on the National Board representing BC. Since getting involved with ACORN, Monica helped organise her apartment building into a tenant union that successfully fought to defeat her landlord’s attempt to pass on a million dollars in building repairs to tenants. She now helps lead the fight to increase tenant protections across BC.

Bader Abu Zahra

ACORN Canada Treasurer

Bader is a retired engineer. He immigrated to Canada in the early 70s and since then has been involved in community struggles for social justice. After being encouraged by his daughter to join ACORN, Bader has become a committed member on several campaigns including affordable and livable housing and fair banking. He was an essential part of the push for a mobile COVID19 testing site in the east end of Ottawa. Since June 2023, he became part of the ACORN Canada National Board.

Nichola Taylor

National Board Representative

Since reaching out to ACORN to get help in fighting a renoviction Nichola has been a positive force to be reckoned with. Since being elected Chair of NB ACORN in June of 2022, Nichola has organized actions and rallies around NB ACORN’s groundbreaking Rent Cap and Renoviction Ban campaigns. In addition to being ACORN’s (and working class tenants) primary spokesperson in New Brunswick, she is also a representative of ACORN's National Board.

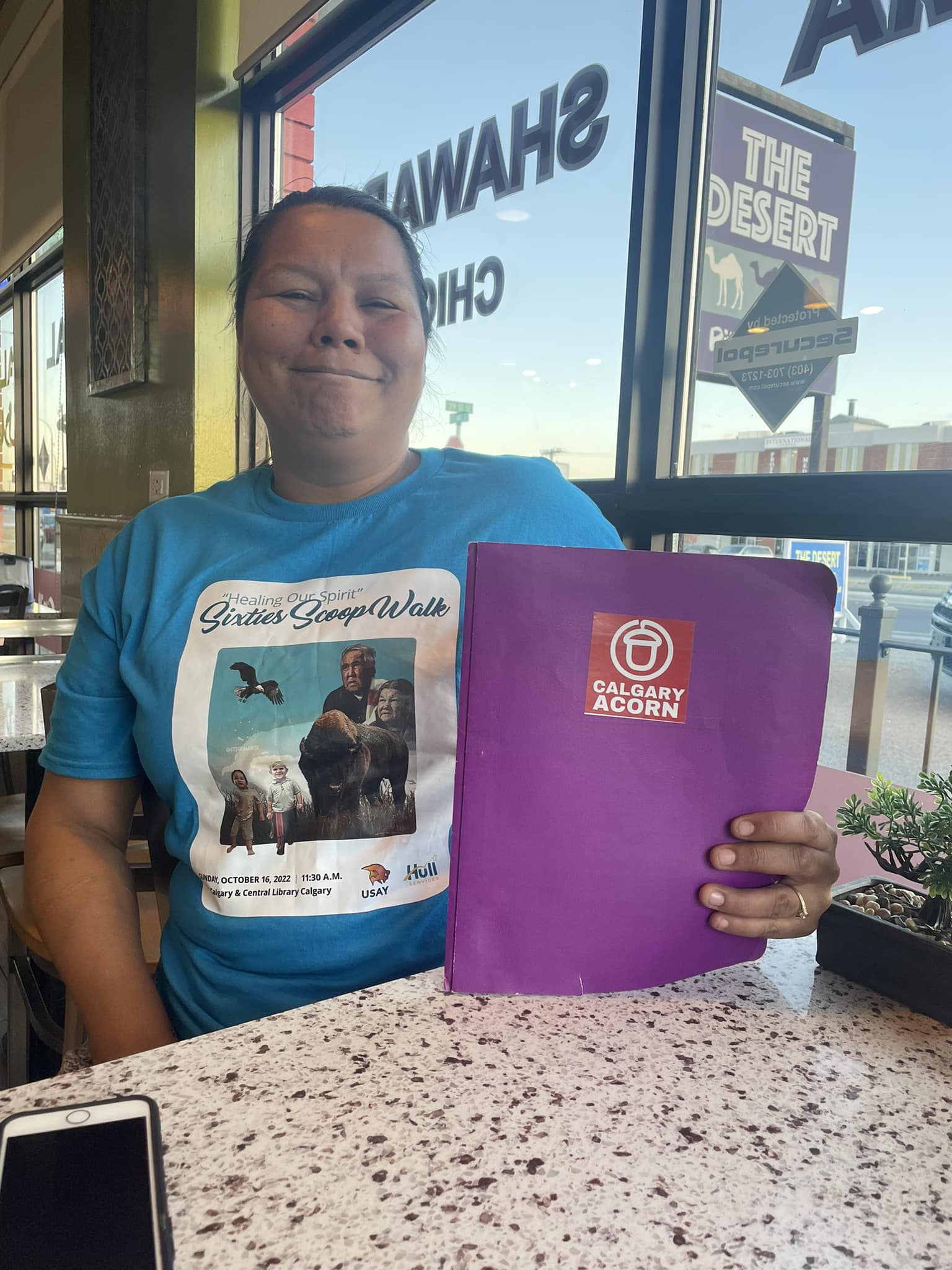

Vanessa Badger

National Board Representative

Vanessa is a Cree/Nakoda First Nations woman who has lived in the East End Calgary neighbourhood of Forest Lawn for 35 years. She is passionate about fighting inequality and racism in Calgary and is active in the community volunteer group Yethka Voices of the Greater Forest Lawn. Vanessa is also the Chair of Calgary East chapter.

Gary Rodden

National Board Representative

Gary Rodden got involved with ACORN when facing evictions and has turned into BC ACORN's strongest voices. A Sapperton resident, Gary brings his political savviness and calm demeanor to the New West Chapter. Gary was elected co-chair of New West ACORN in April 2024 and was selected as a rep on ACORN Canada's National Board in May 2024.