The Hill Times: Fall economic statement should include tax filing help, banking reforms, say advocates for lower income Canadians

Posted November 2, 2023

Finance Minister Chrystia Freeland says this year’s fall economic statement will be ‘narrowly focused’ on three areas: housing, affordability, and fiscal responsibility.

As food bank usage hits record highs across the country, groups representing lower income Canadians say they are optimistic about the affordability measures Finance Minister Chrystia Freeland has signalled in advance of the fall economic statement. But they are also calling for ‘a more comprehensive’ approach that tackles poverty from multiple angles.

Freeland (University—Rosedale, Ont.) has so far declined to say when she will release this year’s fall economic statement, but she has given some indication in recent weeks about the kinds of affordability measures the government is contemplating.

Freeland, Industry Minister François-Philippe Champagne (Saint-Maurice—Champlain, Que.), and Treasury Board President Anita Anand (Oakville, Ont.) previewed the fall economic statement at a press conference on Parliament Hill on Oct. 24. Freeland said the update would be ‘narrowly focused’ on three areas: housing, affordability, and fiscal responsibility. This followed an Oct. 17 announcement from Freeland’s office about measures to ‘ensure Canadians are treated fairly by their banks.’

Elizabeth Mulholland, CEO of Prosper Canada, told The Hill Times on Oct. 30 she is ‘really excited’ by the banking reforms the government has promised recently or is already working on implementing—such as expanding access to low- and no-cost bank accounts, cracking down on certain fees at big banks, reducing the criminal rate of interest, and expanding access to credit.

But Mulholland said she is hoping the fall economic statement will also include ‘a more comprehensive’ and ‘multi-pronged’ approach to affordability. That means helping people file their taxes so they get access to income security programs for which they are already eligible, helping low- and moderate-income households build up emergency savings, and forgiving the CERB debt of people who cannot afford to repay it without starving or losing their homes, she said.

Prosper Canada is a national charity working to expand economic opportunity for Canadians living in poverty. Mulholland said roughly one in five people with low incomes don’t file their taxes, and that this group is missing out on $3,700 on average from tax credits and income supports to which they are entitled—and often more in the case of families with children and people with disabilities.

She said the government has launched pilot programs that provide grants to community tax clinics that help people file their taxes, and that these grants could be expanded and made permanent. She added that with additional resources, these clinics could also work outside the tax season to help people file taxes from previous years.

‘And that’s when you really get large lump sums of money that people are often owed—tens of thousands of dollars. And that’s a life changing opportunity for somebody living on a low income to really turn their financial life around,’ said Mulholland.

Food Banks Canada, a charity that represents food banks across the country, announced last week that food bank use has hit all-time highs. The group’s annual report says there were ‘an unprecedented’ 1.9 million visits to food banks in March—an increase of 32 per cent from the previous year—and that 18.4 per cent of people in Canada now live in food-insecure households.

Food Banks Canada says it ‘sounded the alarms’ in its 2022 report, but that this warning ‘has largely gone unheeded,’ as the lack of government action, at all levels, has exacerbated the problems it identified a year ago. The group’s policy recommendations call on governments to tackle low incomes and poverty—’the root causes of food bank use’—while also providing immediate relief for millions of people.

Since Food Banks Canada released its report on Oct. 25, opposition MPs have repeatedly drawn attention to the record demand for food banks across the country.

Conservative MP Dominique Vien (Bellechasse—Les Etchemins—Lévis, Que.) said in the House on Oct. 27 that 872,000 people in Quebec—one in 10 Quebecers—are relying on food banks each month. Conservative MP John Barlow (Foothills, Alta.) added in the House later that day that a third of food bank users across the country are children. Both joined other Conservative MPs in blaming the government’s carbon tax, and Conservative MP Scott Aitchison (Parry Sound—Muskoka, Ont.) criticized what he called the government’s ‘inflationary spending’ for the rise in food insecurity.

Under questioning from Conservative finance critic Jasraj Singh Hallan (Calgary Forest Lawn, Alta.), Bank of Canada Governor Tiff Macklem told the House Finance Committee on Oct. 30 that government spending has, at times, worked at cross purposes with the central bank’s efforts to lower the rate of inflation.

‘It would be helpful if monetary and fiscal policy was rowing in the same direction,’ Macklem told the committee.

Bloc Québécois MP Sylvie Bérubé (Abitibi—Baie-James—Nunavik—Eeyou, Que.) told the House on Oct. 28 that the Liberals have not kept an election promise to invest $1 billion over five years for a school food program.

ACORN Canada looking for further details on Freeland’s promise to address ‘junk fees’ charged by banks

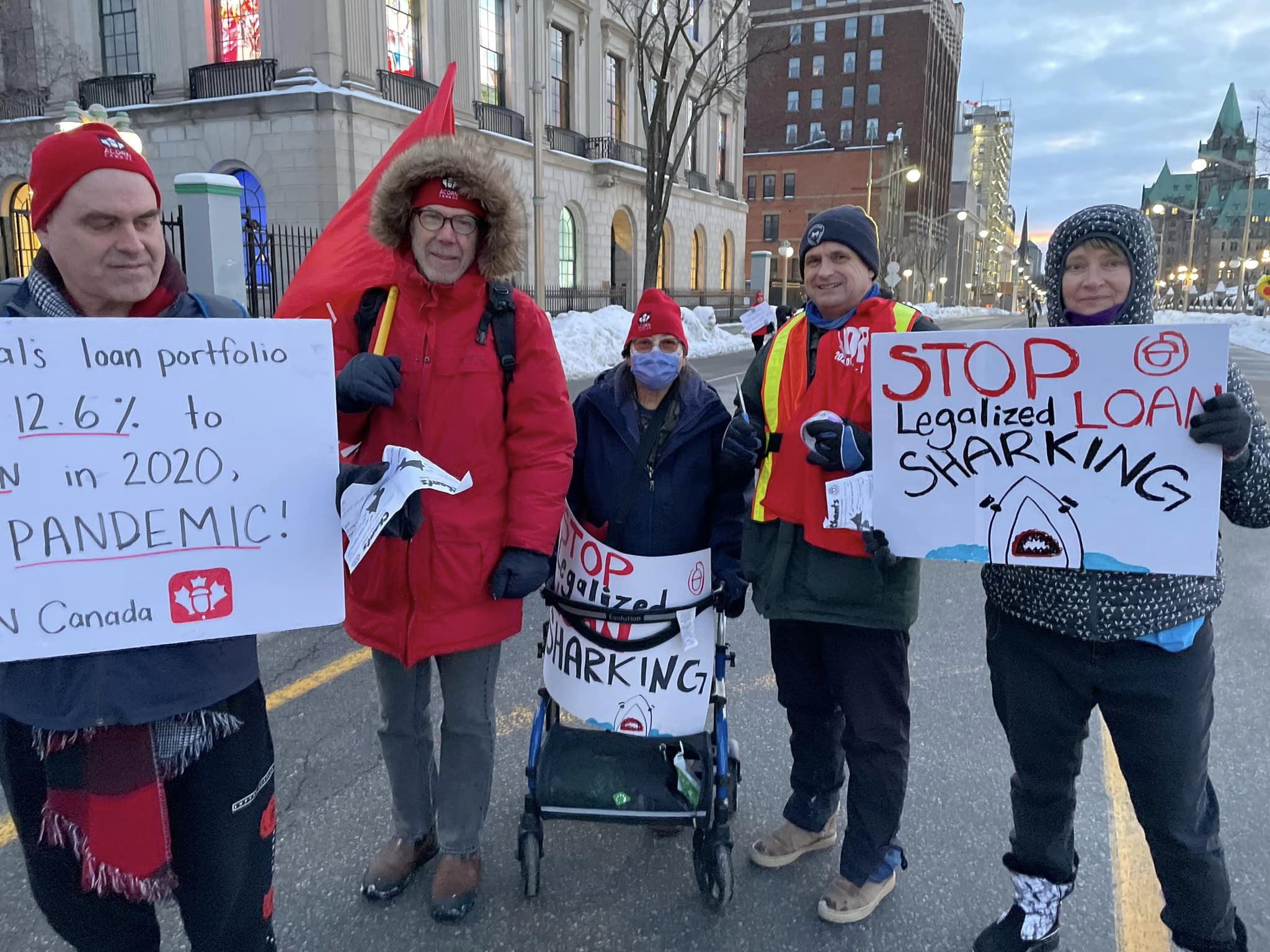

ACORN Canada, a union of low- and moderate-income people, has been cautiously optimistic about Freeland’s promise to address several banking issues that disproportionately affect lower income households. But ACORN representatives have also said they are waiting for further details that will clarify how ambitious these reforms will be, and how quickly they will be implemented.

The organization has highlighted Freeland’s Oct. 17 promise to crack down on ‘junk fees,’ starting with non-sufficient fund (NSF) fees. These are charges in the range of $45 to $50 that Canadian banks apply when customers don’t have sufficient funds to cover a transaction. ACORN representatives say NSF fees are an additional hardship that push people who are already struggling financially away from mainstream banks and towards payday lenders that charge ‘predatory’ interest rates.

Donna Borden, co-chair of the East York (Toronto) chapter of ACORN Canada, said in an Oct. 24 statement that she was ‘glad to see’ the government promise to act on NSF fees, and called for these fees to be lowered to $10 or eliminated entirely.

She pointed out that nearly three quarters of the largest banks in the United States have eliminated NSF fees, saving their customers an estimated US$2 billion a year according to the U.S. Consumer Financial Protection Bureau. ‘Canada has been falling behind other countries in holding large banks accountable,’ said Borden.

Advocates have also called for the federal government to create a national standard for a safe, low- or no-cost bank account, to cut down on fees for online transactions, and to provide lower-income households access to well-regulated, low-cost alternatives to high-interest payday and installment loans.

ACORN has been skeptical about efforts to introduce such measures on a voluntary basis, and has called on the government to make such reforms mandatory for Canadian banks. Mulholland, however, said a collaborative approach would more likely be sustainable in the long term.

‘You could say ‘we’re going to make the banks do it, and they’re just going to have to lose money on it,’’ she said. ‘But that doesn’t feel very sustainable to me. And I would predict that if the government changed, that would go out the window.’

Mulholland said a more collaborative approach might see the federal government absorbing some of the cost of screening borrowers and supporting them with financial education and coaching, while the banks administer the loans and put up the necessary capital.

****

Article by Kevin Philipupillai for The Hill Times