The Globe and Mail: Non-prime lenders warn thousands of borrowers they could be cut off because of new maximum interest rates

Posted January 15, 2024

Hundreds of thousands of Canadian borrowers will be receiving letters from their non-prime lenders, warning they could soon lose access to credit because of new federal restrictions that would cap maximum interest-rate charges at 35 per cent.

The letters started to go out late last week to Canadians who are clients of the more than 300 companies represented by the Canadian Lenders Association (CLA), which represents banks and instalment lenders, but not payday-loan providers.

The letters, titled “Important notice affecting your access to a loan,” alert clients to potential negative consequences resulting from federal plans to lower the allowable rate of interest.

Finance Minister Chrystia Freeland’s 2023 budget announced plans to amend the Criminal Code to lower the criminal rate of interest to above 35-per-cent APR (annual percentage rate), down from a cap of 47 per cent. It also vowed to ensure that payday lenders can charge no more than $14 per $100 borrowed, matching the lowest cap currently in place provincially in Newfoundland and Labrador.

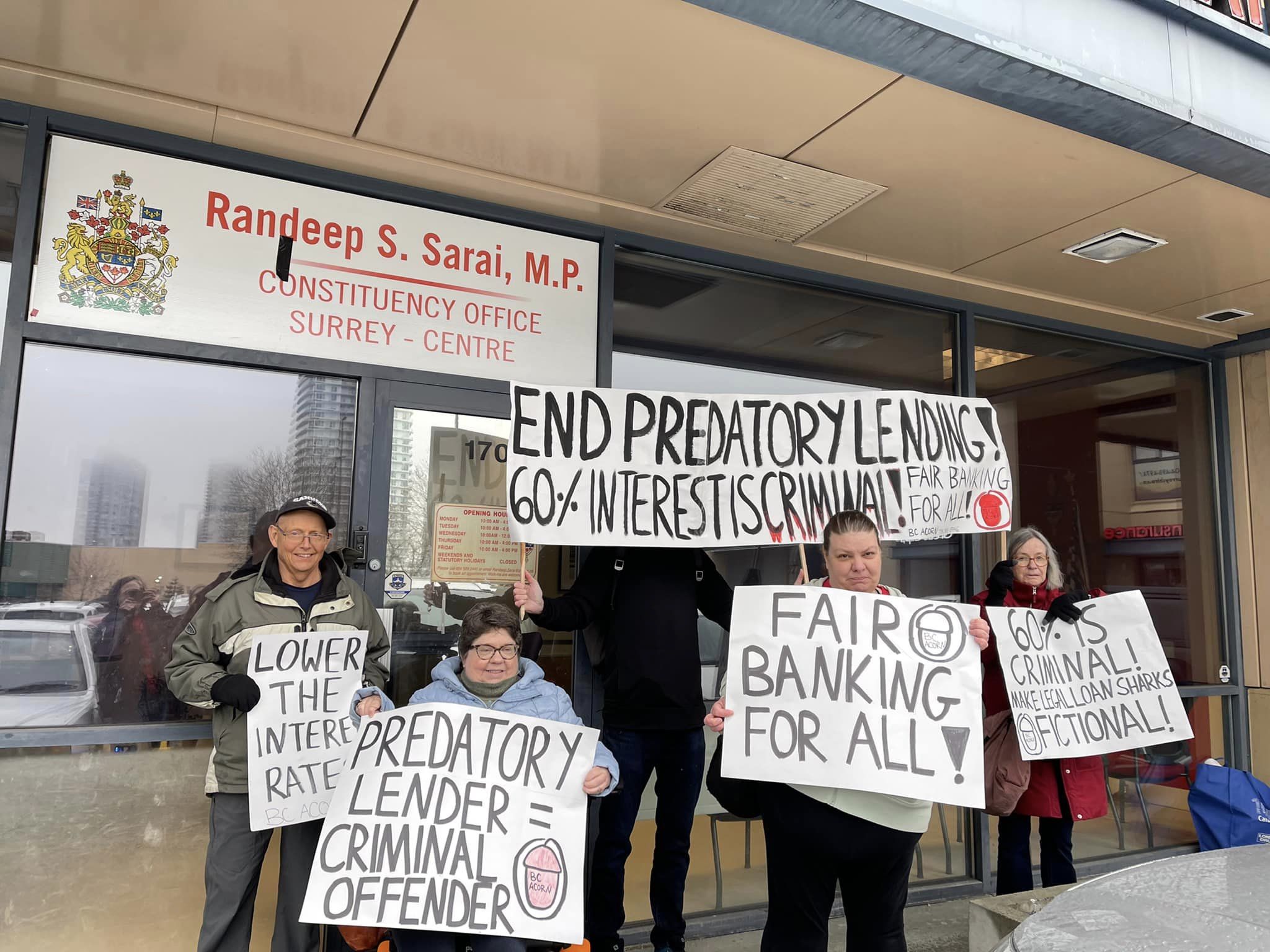

The government presented the package as a crackdown on predatory lending that will help Canada’s most vulnerable people and it has strong support from anti-poverty groups such as ACORN Canada.

The Finance Department has been consulting on details related to the measures, leading to draft regulations that were published in the Dec. 23 edition of the Canada Gazette.

The letters are part of a lobbying effort by the lenders association to persuade Ottawa to include concessions for lenders who serve the millions of Canadians in the non-prime space, meaning their credit scores are not strong enough to qualify for loans at most traditional banks.

The letters provide clients with an option to have their opposition to the federal plans forwarded to Ottawa.

“While on the surface, reducing the maximum allowable interest rate may sound helpful, this change in fact means many borrowers may no longer be able to access a loan in the future, including from other regulated lenders across Canada,” the letters to clients state.

“These changes will potentially make the loans from lenders like us unavailable for millions of Canadians. As a result, consumers may have to rely on other sources of credit, such as an expensive payday loan, which often costs more than 6 times the price of a loan from us,” the letters say.

The prime lending market generally refers to clients with TransUnion credit scores of 720 or more, with 900 being a perfect score. Scores below 720 are considered non-prime.

Generally speaking, lenders charge higher interest rates to clients with lower credit scores. According to research prepared by the CLA using TransUnion of Canada data, there were 26.7 million Canadians with credit reports in 2021, of which 71.2 per cent were considered prime and 27.8 per cent, or 8.2 million, non-prime.

The lenders association estimates that about half of the non-prime customer base, or more than four million people, currently face interest rates above 35 per cent because of their credit-risk profile and would therefore be at risk of losing access to traditional credit under the new rules.

Payday loans are defined in the Criminal Code as an advancement of money in exchange for a postdated cheque or similar form of future payment. Payday loans must be less than $1,500. They are exempt from the criminal interest-rate rules, with conditions, according to a 2007 legal change.

Jason Mullins, president and chief executive officer of goeasy Ltd. and vice-chair of the Canadian Lenders Association, said the impact of the government’s change will actually drive more people to payday lenders at even higher interest rates.

“They believe that they’re helping Canadians improve their affordability by lowering the maximum allowable rates, when in reality, they are going to push millions of Canadians out of access to licensed regulated credit,” he said in an interview.

Katherine Cuplinskas, a spokesperson for Ms. Freeland, defended the changes, saying they will protect vulnerable Canadians. She said in an e-mail that the Finance Department is currently reviewing feedback from Canadians.

ACORN Canada, which describes itself as a community union of low- and moderate-income people, has called on the government to go even further by lowering the criminal rate of interest to 20 per cent.

“It is totally faulty to think that lowering the interest rate will adversely affect the business of these predatory lenders,” said ACORN leader Donna Borden. “If anyone believes that instalment loans help build credit scores, they do exactly the opposite because people fall into a debt trap.”

In exchange for making riskier loans that have a greater chance of not being repaid, lenders charge higher interest rates to help absorb the blow from potential defaults.

Andreas Park, a professor of finance at the University of Toronto Mississauga, said the effectiveness of the government’s policy depends on whether these lenders have been charging high interest rates because it accounts for the actual cost of recovering the money lost in a default, or because they are able to charge inflated prices as a result of high demand for credit products.

Canadians often turn to credit, and are already allocating a record portion of their disposable income to debt payments as heated inflation and the high cost of borrowing weigh on consumer wallets.

“You’re basically trying to squeeze people and charge them the highest possible rate,” he said in an interview. “If this squeezing is actually occurring, then by lowering the max, you could help people. But if this is a competitive market, and then you put a cap in, it just means that the market would disappear.”

One way of ensuring that people have better access to credit would be to establish an alternative method to assessing a customer’s creditworthiness. While credit scores consider a number of factors, the system sometimes fails to accurately assess a person’s ability to repay loans, according to Prof. Park.

Providing greater access to a customer’s financial data through an open banking system – which some advocates say Canada has dragged its feet on implementing – could allow lenders to access additional information that would better demonstrate the strength of a loan application.

“Payday-loan lenders prey on the weak and just try to get them into a debt spiral,” Prof. Park said.

“But they serve a particular part of the population that, in some form or another, is underserved by the traditional world of finance. If you restrict this market, then you’re taking away an option for people to manage their lives.”

****

Article by Bill Curry for The Globe and Mail