CBC News: Toronto city council to consider zoning restrictions on payday loan outlets

Posted February 1, 2022

Posted February 1, 2022

Back in 2019, Shelly-Ann Allan’s bank refused to lend her the money she needed to help pay for her father’s funeral, so she had to turn to a payday loan company.

Back in 2019, Shelly-Ann Allan’s bank refused to lend her the money she needed to help pay for her father’s funeral, so she had to turn to a payday loan company.

But what she didn’t account for was the death of her stepfather shortly after. She had to take out another payday loan on top of the one that still had a balance of $1,500.

“The interest rates [have] built up and built up on me, and there’s where it’s affecting me right now,” said Allan, who lives near Jane and Finch, an area of the city that has a disproportionately large number of payday loan companies.

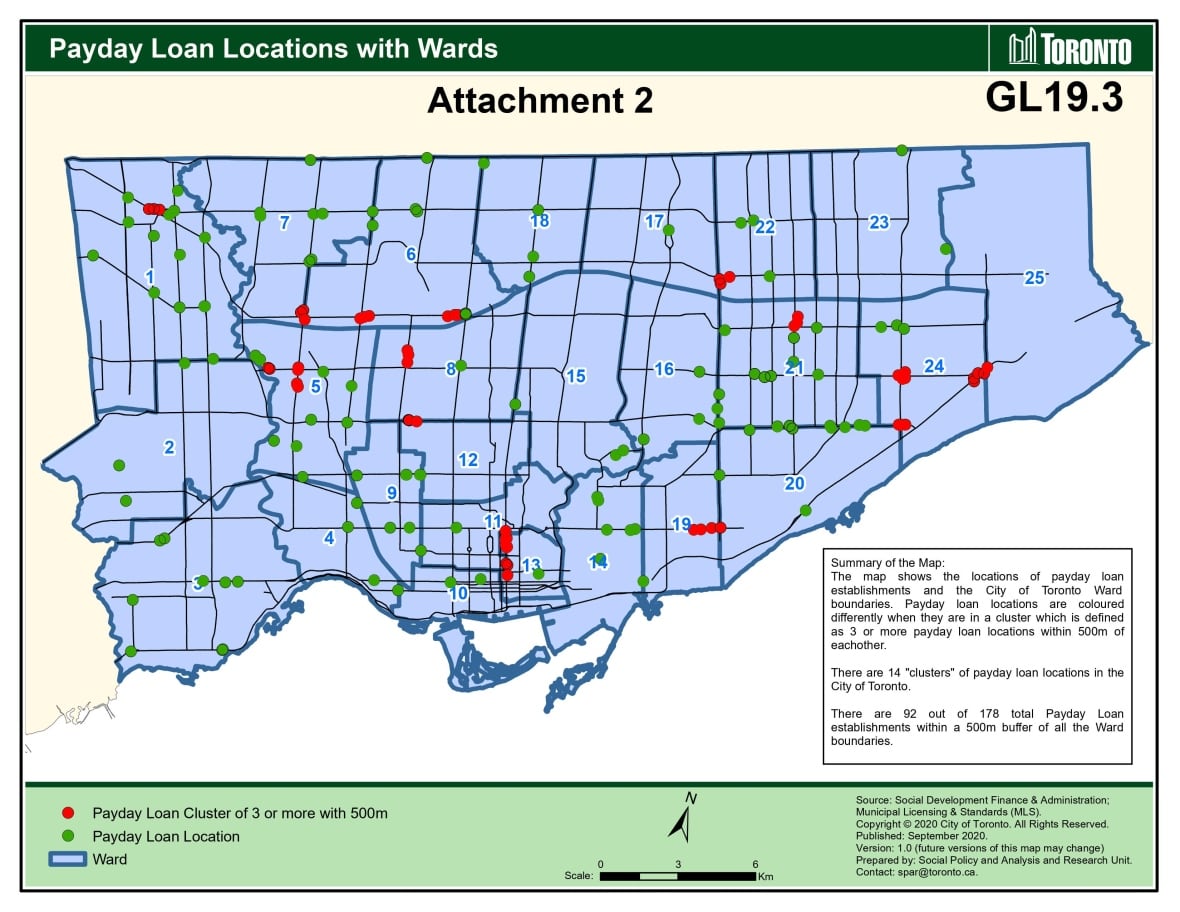

Critics say the concentration of such businesses in low-income communities helps perpetuate the cycle of poverty. That’s why Toronto city council is discussing a recommendation this week from its Housing and Planning Committee that would bar new payday loan outlets from setting up shop within 500 metres of social services offices, social housing, liquor stores, casinos and pawnshops.

According to Allan’s contract with the payday loan firm easyfinancial, her cumulative interest rate now stands at 47 per cent, and she now owes $24,000. She says where she lives, people need more than just zoning restrictions to restrict payday lenders, they also need financial institutions that will lend them money at reasonable interest rates.

“People like myself … the bank wouldn’t look at me to lend, because they said that I would not be able to pay back that money,” said Allan.

Zoning limitations

Currently, lenders in Ontario can charge no more than $15 in interest for every $100 borrowed.

Despite that, University of Toronto finance professor Andreas Park says annual percentage rates can hit over 400 per cent for short-term payday loans, and additional interest can be applied if the loan isn’t paid by the term’s end, according to the Payday Loans Act.

A 2021 report by city staff says zoning restrictions would only apply to new establishments, and could not retroactively apply to existing ones.

In 2018, the city capped the number of payday loan licenses and locations. The city says this has contributed to a more than 20 per cent decrease in such establishments, from 212 to 165 as of Jan. 26. But a new supplementary report released days ahead of this week’s city council meeting shows there has been limited movement by the remaining payday outlets, with only three moves since the city brought in those restrictions.

Staff recommended finding “improvements to consumer protection and access to low-cost financial services” as a way to regulate the industry.

Coun. Anthony Perruzza, who represents Ward 7, Humber River-Black Creek, says that’s all part of the city’s Anti-Poverty Reduction Initiative.

“But that plan is still in the works, and it’s still some years in the making.”

Andreas Park, a professor of finance at the University of Toronto, says zoning restrictions against businesses are limited in their ability to tackle the heart of the problem.

“It is rather striking that these payday lenders are so prevalent in poor neighbourhoods, and that there is no better service being given,” said Park, who agrees people in those neighbourhoods need better access to loans with reasonable interest rates.

“Why do we not have systems in place that help them overcome some of the challenges that they face?”

ACORN Toronto, an advocacy organization for low and middle-income groups, says while it welcomes the reduction in payday loan outlets, the city should follow Ottawa and Hamilton, which have already implemented zoning restrictions.

“The more frequently residents see these businesses, the more likely they are to consider accessing the high compounding interest loans,” wrote Donna Borden, the head of East York ACORN, in a letter to the city.

“We believe this is not about planning rationale, it’s about equity, human rights, and fair banking.”

City needs federal, provincial help

The last time council discussed the topic was December 2020, where it made numerous requests to the federal government to increase enforcement against predatory lending and to the province to provide cheaper loan options for consumers.

The Ontario government has told CBC News it is reviewing feedback from a 2021 consultation with stakeholders and the public on ways to tackle the problem..

Additionally, the federal Ministry of Finance said in an email statement that the government is looking at cracking down on predatory lenders by lowering the criminal rate of interest, which is now set at 60 per cent. However, payday lenders are exempt from this provision in provinces that have their own financial regulation system, such as Ontario.

Perruzza says COVID-19 has added more urgency into the discussion, and he warns change from all levels of government can’t come fast enough.

“A lot of the folks … are people that aren’t getting support from the federal government,” he said.

“They don’t get support with the traditional programs that are out there, and they are trying … to make ends meet and then they’re further being victimized by predatory lenders,” he said.

“We really need to impress on the federal and provincial governments that this is a huge problem, and they need to use their legislative tools at their disposal.”

***

Article by Vanessa Balintec for CBC News