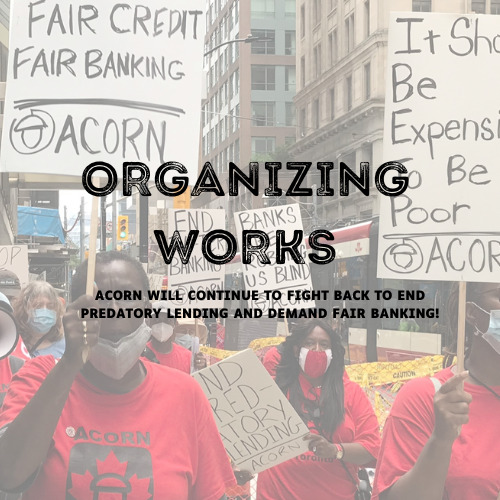

Organizing works! The feds lower the criminal interest rate for predatory installment loans from 47% to 35% APR

Posted March 28, 2023

Today, the Federal Government announced in the Budget 2023 that the government will introduce changes to the Criminal Code by lowering the criminal rate of interest from the equivalent of 47% to 35% Annual Percentage Rate (APR). The government has also committed to launch consultations to see if it can be further reduced.

Donna Borden, a National ACORN leader and a champion of ACORN’s fair banking campaign, who herself was caught in a vicious cycle of an installment loan she took out from Citi Financial says:

“Organizing works! This change is a result of persistence of ACORN members who spoke out and fought for this important change. People shouldn’t be afraid of speaking out. This policy change will help low- and moderate-income people save hundreds of millions of dollars. ACORN looks forward to the government as this policy further cracks down on predatory lenders”.

ACORN members have championed the campaign on Fair Banking for years. Due to the failure of the banks, low- and moderate-income people are forced to go to predatory lenders such as Money Mart, Easy Financial, Cash Money that prey on poor people. ACORN saw a 300% jump in the uptake of installment loans between 2016 and 2020. This is HUGE as the predatory lending industry jumped to fill the void created by the banks to offer larger amounts of loans that carry an interest rate of 60% plus insurance, fees etc. ACORN won a commitment from the federal government in Budget 2021 to lower the criminal rate of interest for installment loans. As a result, the federal government launched a consultation last year to which ACORN sent in more than 600 submissions. ACORN’s written submission can be found here.

ACORN members are very happy with today’s announcement. Next we look forward to seeing the government work towards the following:

- Ensure that the lowered criminal interest rate of 35% includes ALL associated lending costs: fines, fees, penalties, insurance, or any related cost.

- Make enforcing violations accessible to borrowers. Current requirements such as an actuarial certificate, present far too great a barrier to identifying and prosecuting a criminal case of interest.

- Create a federally funded Fair Credit Benefit so that all low-income people have access to low-cost credit options in case of emergency.

- Support fair lending alternatives like postal banking in all cities.