ACORN wins $10 cap on predatory NSF fees!

Posted March 19, 2025

ACORN members across the country are celebrating a huge victory in the fight against predatory banking fees. After years of relentless organizing, the federal government has officially announced the implementation of capped Non-Sufficient Funds (NSF) fees at $10!

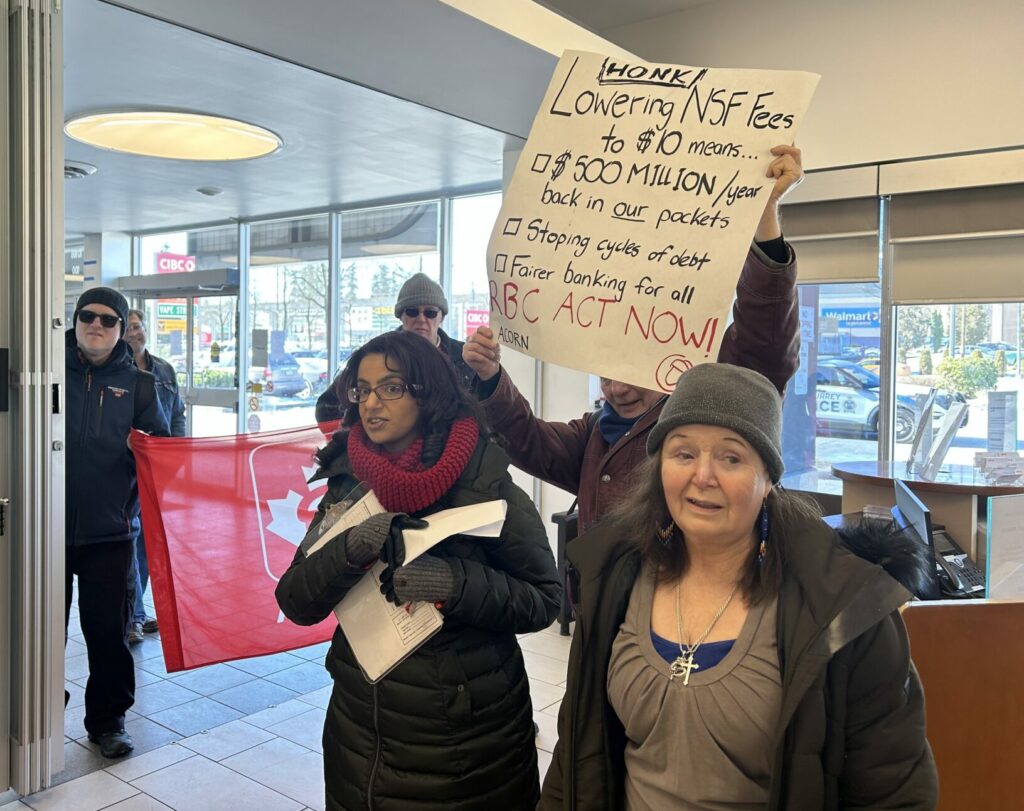

This is following our National Day of Action Against Predatory NSF fees, where we urged the Federal Government to keep their commitment to accessible banking for low- and moderate- income people!

This is a major win for low- and moderate-income Canadians who have long been gouged by fees as high as $48 for a single declined transaction. These changes will directly benefit millions of Canadians—especially renters, single parents, gig workers, and people living paycheque to paycheque—by preventing fees from spiraling into deeper financial hardship.

This new policy will:

- ✔ Cap NSF fees at $10, ensuring that banks can no longer charge exorbitant penalties when someone’s account is short on funds.

- ✔ Stop banks from stacking NSF fees, prohibiting multiple charges within a two-business-day period.

- ✔ Protect against small overdrafts, ensuring that banks cannot charge NSF fees if an account is only short by less than $10.

Over the next decade, this cap is expected to save Canadians over $4.1 billion in unnecessary fees. That’s $410 million dollars a year! That would cover the yearly grocery expenses for nearly 27,000 four-person families! But there’s one last hurdle: the policy won’t take effect until March 12, 2026—a full year away. For families already struggling with rent hikes and inflation, waiting another year is unacceptable.

ACORN is now pushing to fast-track implementation so people aren’t forced to keep paying exploitative fees in the meantime. And we’re continuing to fight for stronger banking regulations, including protections against overdraft fees and other predatory charges.

We won’t stop until financial services are fair for all of our members.