ACORN calls on the federal government to keep its commitment to crack down on predatory lending on the National Day of Action on Fair Banking

Posted April 1, 2022

Posted on April 1st, 2022

On March 31st, ACORN did a National Day of Action on Fair Banking to call on the federal government to act on its commitment to crack down on predatory lending.

On March 31st, ACORN did a National Day of Action on Fair Banking to call on the federal government to act on its commitment to crack down on predatory lending.

A new ACORN report shows that predatory lenders – Money Mart, Easy Financial, Cash Money and the like – preyed upon low- and moderate- income people during the pandemic. The report finds an ever-increasing usage of installment loans (loans more than $1,500) which is extremely disturbing. Vast majority of people took out high-cost loans to meet basic expenses such as rent, groceries, medical reasons etc.

To read the report, click here

Summary of the report is here

Couldn’t join? You can still take action by sending a letter to the Prime Minister, Finance Minister and your MP. Click here

Hamilton ACORN members dropped a demand letter at Money Mart across from East Gate Mall and petitioned and fliered on Queenston Road to let people know about ACORN’s fair banking campaign.

Hamilton ACORN members dropped a demand letter at Money Mart across from East Gate Mall and petitioned and fliered on Queenston Road to let people know about ACORN’s fair banking campaign.

Ottawa ACORN members were out with Vanier ACORN veteran leader, Bader Abu Zahra co-running the action with new up & coming leader Atlas Ruth! After launching the report in a park off Montreal Rd members marched to 4 payday lenders (all within 800m!) to deliver letters to Money Mart, Capital Payday Loans, Eazy Cash and Cash Money. Energy was high with new member Israel Hakizimana on the megaphone! Bader also did a CBC interview earlier in the day.

Ottawa ACORN members were out with Vanier ACORN veteran leader, Bader Abu Zahra co-running the action with new up & coming leader Atlas Ruth! After launching the report in a park off Montreal Rd members marched to 4 payday lenders (all within 800m!) to deliver letters to Money Mart, Capital Payday Loans, Eazy Cash and Cash Money. Energy was high with new member Israel Hakizimana on the megaphone! Bader also did a CBC interview earlier in the day.

Toronto ACORN members marched to a Money Mart from where ACORN member Suzette Mafuna took out an instalment loan and has been dealing with harassment & extra fees being taken out of her account with no explanation why! Members delivered a letter of demands and wouldn’t leave until they accepted the letter.

London ACORN members met outside Cash 4 You location where a member Dezerae Sturgeon had taken out a payday loan and has since been in a constant cycle of debt. ACORN leaders Nawton Chiles and Claire Wittnebel spoke about the predatory lending practices and how people get forced into endless cycles of debt. Both Dezerae and Betty Morisson spoke about their experiences with predatory lenders. CTV London spoke to the members and covered the event. Members delivered a demand letter to Cash 4 You demanding that Dezerae’s loan be waived.

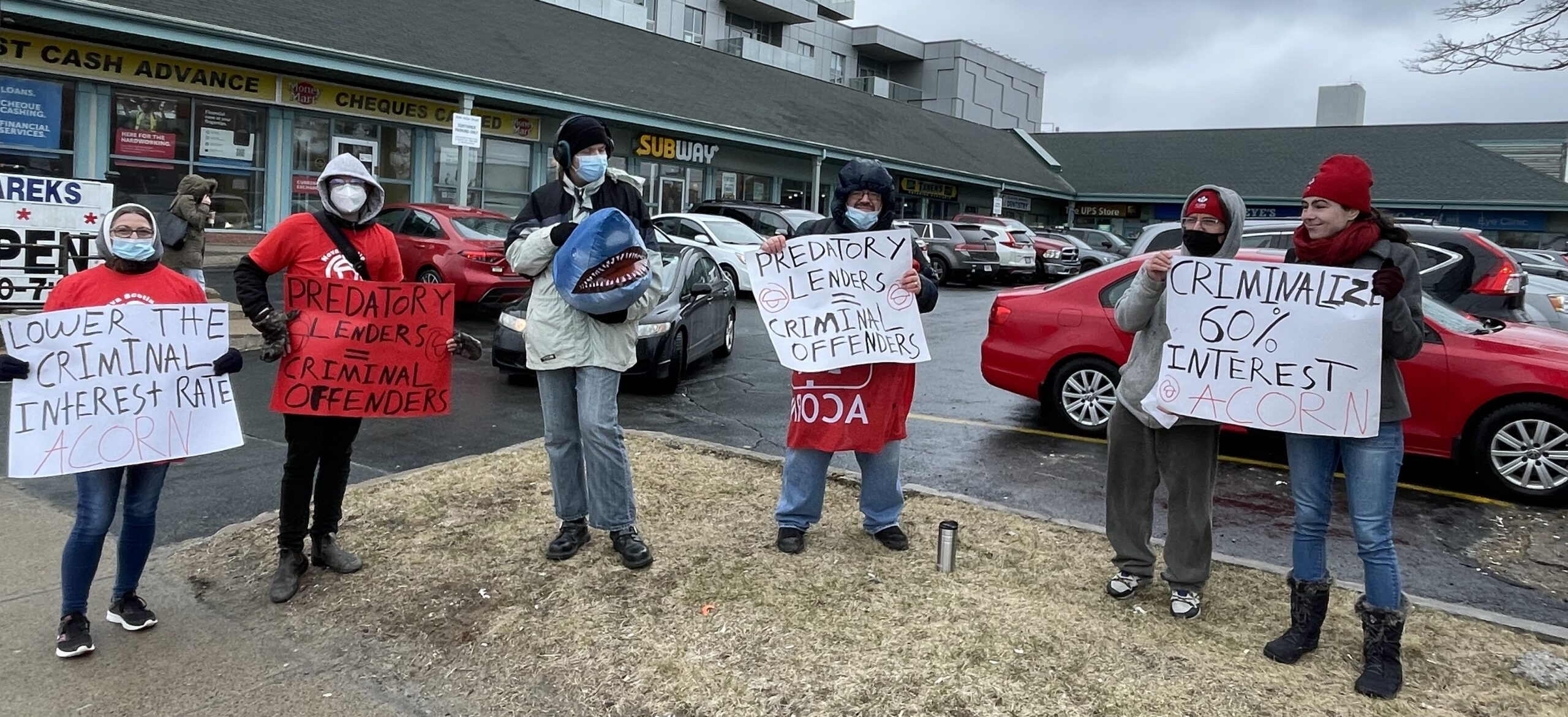

NS ACORN had a great action outside the Money Mart at 3045 Robie st. Members across the city turned out to protest the high interest rates and bad business practices used by Money Mart and other payday lenders. ACORN members also called upon the Trudeau Government to keep its promise to lower the criminal interest rate and end tier 2 banking. New leader helped run it, and Global News was there to cover the action.

ACORN will keep the pressure on to ensure that the federal government launches a consultation and starts the process of lowering the criminal rate of interest of installment loans from 60% to 30%.

PRESS

Toronto Star: Editorial: Predatory interest rates target the poor. It’s time for Ottawa to act

Toronto Star: Opinion: Loan sharks are pulling Canadians under

Hamilton Spectator: Editorial: It’s past time for action on payday loans

Toronto Star: More low-income Canadians took out instalment loans during the pandemic — and had to pay interest rates of up to 60%

Wealth Professional: Report urges government action against high-cost loans

Blackburn News: Survey finds pandemic forces more families to resort to high cost loans

CTV News: London payday loan lenders targeted by protesters calling for change

CTV News: COVID-19 prompted more lower income Canadians to seek high-interest loans: report

CBC Radio: Moneylenders profit from pandemic: ACORN Canada report