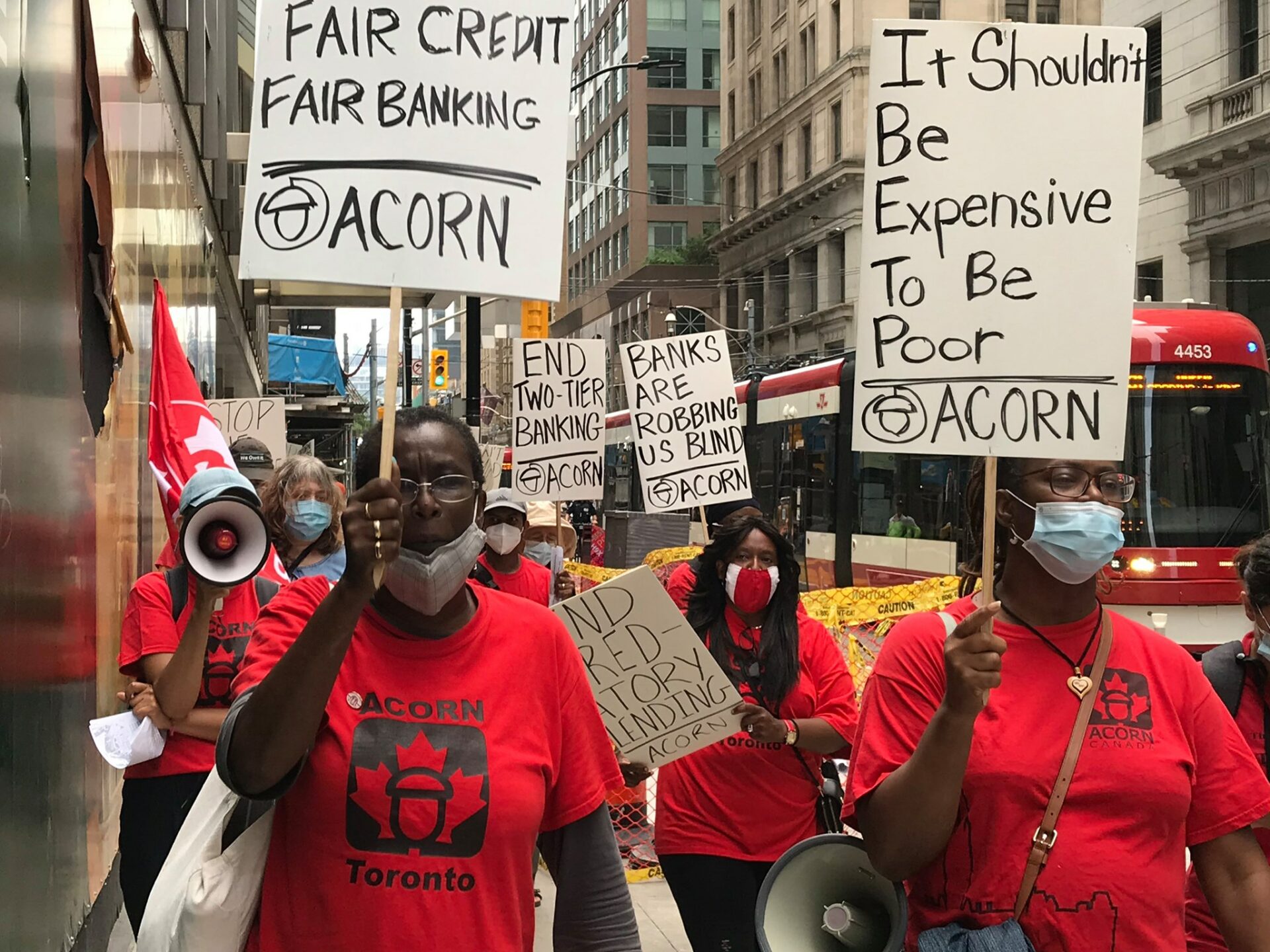

Fair Banking

The failure of mainstream banks is forcing hundreds of thousands of low- and moderate-income Canadians to borrow money from lenders like Easy Financial, Money Mart, Cash Money and many others that charge predatory interest rates. Payday loans (less than $1,500 paid back in 2 weeks) have an annual interest rate of 400-600%, while installment loans (higher dollar loans to be paid in installments) have an annual interest rate of 60% plus insurance & other charges. ACORN saw a 300% increase in the uptake of installment loans between 2016 and 2020. ACORN launched a national campaign in 2005 to END predatory lending. Since then, ACORN has won a number of borrower protections at the city and provincial level across the country. BC and Ontario lowered the fee per $100 from $21 to $15. The federal government launched a consultation to lower the interest rates of installment loans. ACORN's fight to hold predatory lenders and banks accountable continues!

ACORN’s demands

- Lower the criminal rate of interest from 60 to 20% plus Bank of Canada rate or 30% whichever is lower. Maximum rate should include all associated lending costs: fines, fees, penalties, insurance, or any related cost.

- Bring back the payday loans under the ambit of Criminal Code of Canada so it gets regulated federally not provincially.

- Make enforcing violations accessible to borrowers.

- Create a federally funded Fair Credit Benefit so that all low-income people have access to low-cost credit options in case of emergency.

- Support fair lending alternatives like postal banking in all cities.

- Lower the NSF fee from $45-50 to $10.

Explore the latest on Fair Banking

News

Posted: February 13

Resources

Posted November 28, 2024