CHMA Talks: Minimum Wage in New Brunswick

Posted April 3, 2021

Posted April 3, 2021

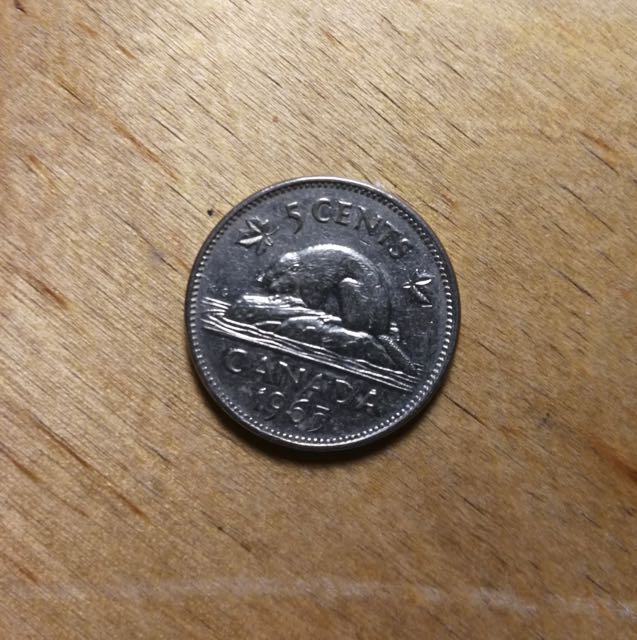

It’s April 1st, which means a meagre 5 cent raise in New Brunswick’s minimum wage takes effect today.

It’s April 1st, which means a meagre 5 cent raise in New Brunswick’s minimum wage takes effect today.

The five cent raise is linked to the rate of increase in the Consumer Price Index as measured in December 2020, when it was less than half a percent (0.4%). By linking the increase to CPI, New Brunswick ensures that minimum wages will likely never increase in real terms. But with this year’s wonky CPI inflation rates, it’s actually possible that minimum wages might decrease in real terms, if/when inflation returns to higher levels.

New Brunswick’s minimum wage raise is the lowest increase in Atlantic Canada, and brings the legal minimum you can pay someone here to $11.75 per hour, or just above $21,000 per year for someone working 35 hours per week.

The rest of the Atlantic provinces will all see bigger increases, and all started with minimum wages over $12 per hour. In Newfoundland the minimum wage is going up by 35 cents to $12.50 per hour. Nova Scotia will increase by 40 cents to $12.95 per hour, and PEI has the highest minimum wage in the region, with a 15 cent hike bringing it $13 per hour.

Today at 1pm, anti-poverty group ACORN held an Atlantic-wide Phone Zap event, calling for a $15 minimum wage, which translates to a minimum annual income of just over $27,000 for a full-time worker.

A phone zap involves many people making phone calls at the same time, to one or group of people, all with a similar message.

CHMA called up ACORN NB organizer Jill Farrar to find out more about the action and the motivations behind it.

“It’s basically an insult,” says Jill Farrar about New Brunswick’s underwhelming 5 cent raise in the minimum wage that went into effect April 1.

“With the pandemic, we’ve seen increases in food costs, increase in rent costs, increase in cost of housing in general, gas is going up. So people are going to be spending more money, but they’re not getting any more with this minimum wage increase,” says Farrar. “It’s basically like it didn’t happen.”

Farrar says the minimum wage affects lots of low income workers. “It’s your essential workers, basically, who have been working at our grocery stores or gas stations, restaurants, all this time,” she says. “I think it’s going to be putting more people into the low income category than there may have been previously, because the costs are rising and the wages are not.”

The $15 per hour minimum wage that ACORN NB is asking for is still below the living wage in Saint John, as calculated by the Canadian Centre for Policy Alternatives in 2020. The CCPA estimated $19.55 as a basic living wage for a family of four, with two adults, both working full time. The 2020 calculation was up 7.5% over the living wage calculated back in 2018.

Farrar is critical of the messaging coming from Premier Blaine Higgs around the impacts of measures like EI and the CERB on employment. Higgs said the EI system was “broken” last week after Cooke Aquaculture had trouble hiring workers recently laid off by a competing fish plant.

“The real problem,” says Farrar, “is that the wages in the province are low, and going to work with no sick pay, no vacation time, no benefits, it’s just really not worth it for your mental health.”

MINIMUM WAGE SUBJECT OF VIGOROUS DEBATE WITH ECONOMISTS

To give us further context about what this minimum wage hike means and the debate over how minimum wages affect the economy, CHMA called up Mount Allison economist Craig Brett.

Economist Craig Brett says today’s tiny hike in minimum wage will probably not make much of a ripple in the economy.

First of all, the hike appears to be based on the December 2020 rate of increase in the Consumer Price Index, says Brett, which means minimum wage should be in step with inflation. But that doesn’t mean it will be.

“If you look at the inflation rates in New Brunswick over the last year,” says Brett, “they’ve been negative, they’ve been positive, they’ve been as high as two as low as -1.7.”

There’s no guarantee that inflation remains low for the next year, meaning in real terms, minimum wage earners could actually lose income, because what they make has only increased 0.4%, and costs may very well grow at a higher rate.

“I don’t think under 1% inflation is the kind of thing that we’re going to see persisting for very long,” says Brett. “Now, I know the economy’s still in turmoil with the pandemic still not 100% under control. So I think all predictions are off for the next year.”

There’s a vigorous debate among economists on what the effect of minimum wages are on the economy, says Brett. One of the key effects that’s studied is the effect of minimum wages on employment, especially when considered according to classic supply and demand. “As wages go up, firms find it more difficult to hire people until they hire less of them,” says Brett. But, he says, “that effect is a lot smaller than a lot of people claim.”

Brett mentions Dalhousie economist Lars Osberg, who specializes in inequality, and his demonstrations of how small the effect of minimum wage increases are on employment. In his book, The Age of Increasing Inequality, Osberg writes that, “when similar jurisdictions with and without an increase in the minimum wage are compared, the job loss effects of higher minimum wages have been very close to zero,” based on a 2014 research review.

“There is a famous study in the US, in metropolitan areas that cross state lines,” says Brett. “You’re in the same metropolitan area, you can set up your fast food restaurant on either side of the state line and still serve roughly the same clientele,” says Brett. “And the two states have different minimum wages. You’d expect those to be the places where you’d see the biggest effect on employment. And even in those cases, we don’t see huge effects.”

Brett says that studies can show effects on job markets, but he characterizes those effects as small to moderate. A 10% raise in minimum wage might correspond with a 4% loss in minimum wage jobs, he says, and that would be an “upper bound” on the amount of job loss.

“I mean, labour costs matter,” says Brett. “They are among the biggest costs for employers. But when we’re talking about the range of increases in minimum wages that we tend to see in the world, they aren’t huge to begin with.”

There is some evidence that when the minimum wage goes up, that effect trickles upward in the economy, says Brett. “Some people have found a little bit of evidence that a rise in the minimum wage tends to percolate up the income distribution just a little bit,” he says. While it might not reach all the way up to the higher echelons of the income distribution, says Brett, a raise in minimum wage may give the people making just above minimum wage a boost in their income, too. “This seems to happen without a whole lot of effect on their employment,” he says.

All that said, “there’s also not a whole lot of evidence that increases in minimum wage have much effect on rates of poverty,” says Brett. That could have to do with a number of factors, including that “these effects on employment, even though they’re small on aggregate, may be disproportionately felt at the lower end of the income distribution,” he says.

“Minimum wage is not the first port of call,” says Brett, “if you wanted something that would make a big dent in poverty reduction.”

Ultimately, Brett says that minimum wage may have more to do with a value system than the nitty gritty of an economic model.

“The minimum wage is a marker of the policy stance on what fair compensation is for people,” says Brett. “There’s more to this than just, ‘does the employment go up or how many people are in poverty?’ There’s a sense of a marker of fairness here, in what people ought to be paid.”

“That’s part of what’s going into this,” says Brett. “And I think the number that comes out is partly reflective of that, as much as anybody in a backroom, trying to run a sophisticated economic model to decide within two tenths of a cent what the appropriate minimum wage ought to be.”

***

Article by Erica Butler for CHMA FM