The Globe and Mail: Ontario court approves TD Bank’s insufficient fund fees settlement

Posted February 20, 2024

The high cost of not having enough money is being brought into focus by a class-action lawsuit at one of the country’s largest banks.

Court documents in the case against TD Bank included a stark example from lead plaintiff Tyler Dufault, who was charged $96 in fees by the bank after he fell 45 cents short on a PayPal bill.

A $15.9-million settlement of the suit, which focused on whether the bank had properly disclosed that customers could be twice charged the $48 non-sufficient funds (NSF) fee, was approved this week by the Ontario Superior Court.

The settlement comes as scrutiny grows more generally on the charging of such fees, including a push to lower them by the federal government.

In the U.S., many banks have already moved to eliminate the fees thanks to pressure from regulators, while in Canada advocates are also pushing to reduce them or do away with them entirely.

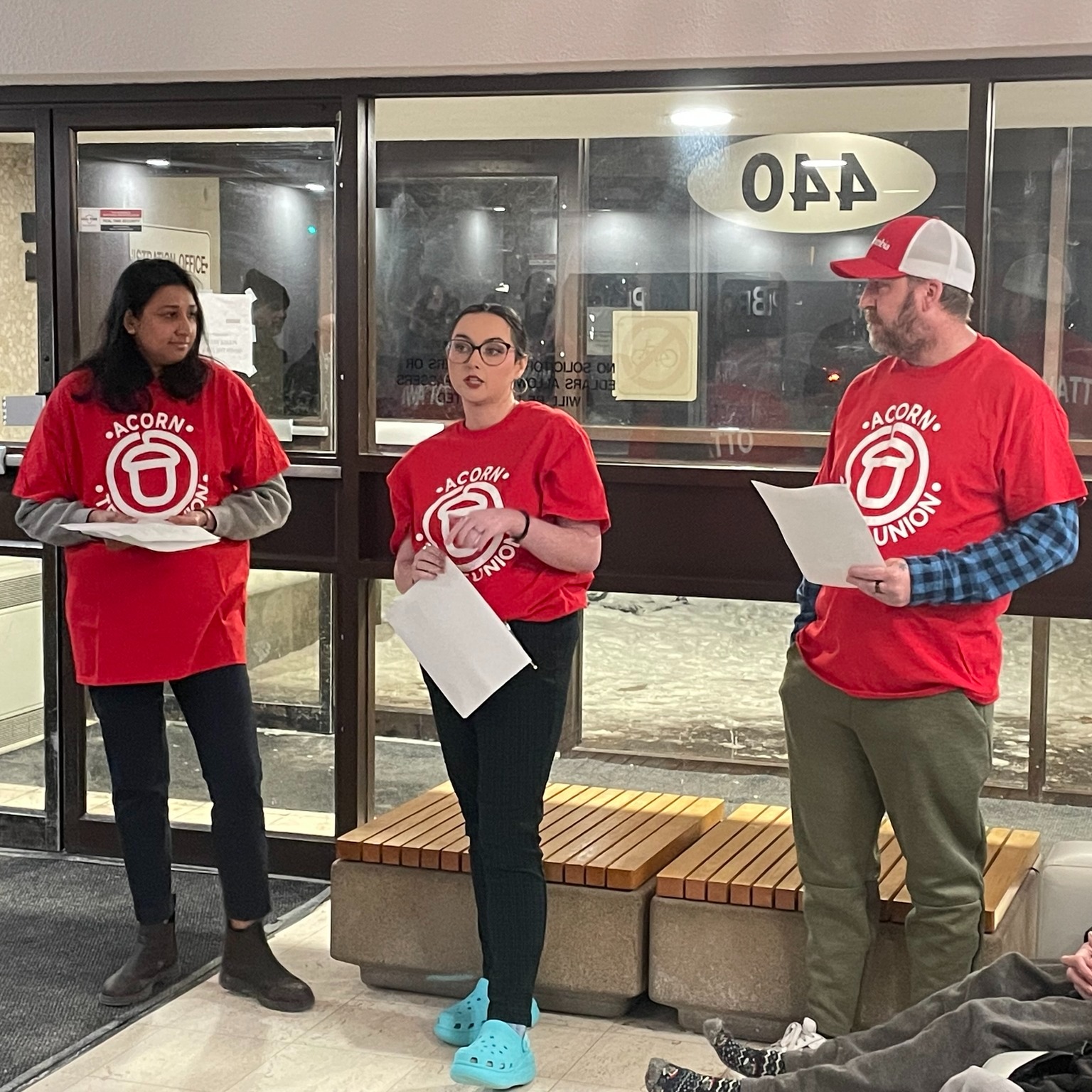

“This is just another predatory practice of the banks, to charge such a large amount of money,” said Donna Borden, a leader at anti-poverty advocacy group ACORN.

Big banks in Canada charge between $45 and $50 when there isn’t enough money in the account to process a pre-authorized debit such as an automatic bill payment. If the transaction is rejected, merchants are allowed to try to put it through a second time within 30 days.

TD, which didn’t admit any liability in the settlement, agreed as part of the terms that it would amend its disclosures, and would also change its policy to allow for a full reversal of the fee for a first-time issue raised by a customer.

It maintains that it’s not clear to the bank if it is facing the same charge a second time or a new purchase.

“Each payment instruction is a unique transaction,” said TD spokeswoman Ashleigh Murphy, noting that the bank has also set up balance alerts to help customers avoid NSF fees.

The settlement should provide about $88 in compensation for the 105,000 or so TD customers who were double-charged between Feb. 2, 2019 and Nov. 27, 2023, giving a sense of how many people get caught up in these fees.

Adam Tanel, a partner at Koskie Minsky which brought the class action and is pursuing similar ones against the remaining Big Five banks (RBC, BMO, Scotiabank and CIBC round out the list), said it was nice to know customers would be getting back money soon for what seems like a very high fee.

“Once upon a time there was a lot more work that went into a bank honouring or dishonouring a cheque,” said Tanel.

“The notion of a $48 fee, for an electronic transaction that doesn’t go through, it certainly rankles.”

It’s not clear how much processing these transactions cost banks, but it could be minimal.

The Consumer Financial Protection Bureau in the U.S., which has been pushing aggressively against junk fees, said in a January report that the average cost of non-sufficient funds handling for debit transactions was likely less than US$0.005 each – that’s half a cent.

Nearly two-thirds of U.S. banks with more than $10 billion in assets have eliminated the fees, which the CFPB expects to save consumers $2 billion a year.

Among them are TD Bank and BMO’s U.S. subsidiary, both of which did away with NSF fees in 2022. Neither followed suit in Canada.

In ending the fees, BMO head of consumer strategy Paul Dilda said the change marked a milestone in empowering customers to achieve real financial progress.

BMO, RBC, Scotiabank and CIBC declined to answer any questions related to NSF fees, citing the ongoing lawsuits.

There are differences in the Canadian and U.S. markets, including that NSF fees aren’t charged on immediate debit transactions here, since they’re processed in real time so they’re rejected without any fees if there isn’t enough money in the account.

The Canadian government has also forced banks to adopt several protection measures in recent years, including rolling out low-balance alerts to help customers avoid the fees.

It could go further in the next budget, committing to lowering NSF fees because they disproportionately impact low-income Canadians and those who may not have access to overdraft protection because of their credit history.

Borden at ACORN said there are all sort of ways people can get caught out. At her work there was a payroll issue, leaving several colleagues caught out as automatic payments like insurance went through even as wages didn’t come in.

The employer compensated them in that case, she said.

But ultimately there are many people struggling, just staying above water that the unexpected timing of a charge could push them under.

It’s easy to say people should have the money in the bank, but it’s not so simple, said Borden.

“Who has money when you’re poor? You just have only so much.”

****

Article by Ian Bickis for Canadian Press