Mississauga News ‘Nice idea’: Will Mississauga’s new inclusionary zoning rules boost housing affordability?

Posted August 31, 2022

Builders’ associations and anti-poverty groups may not agree on much, but they do seem to share a common belief that Mississauga’s new inclusionary zoning policy won’t meet its goal of boosting numbers of affordable units in the city.

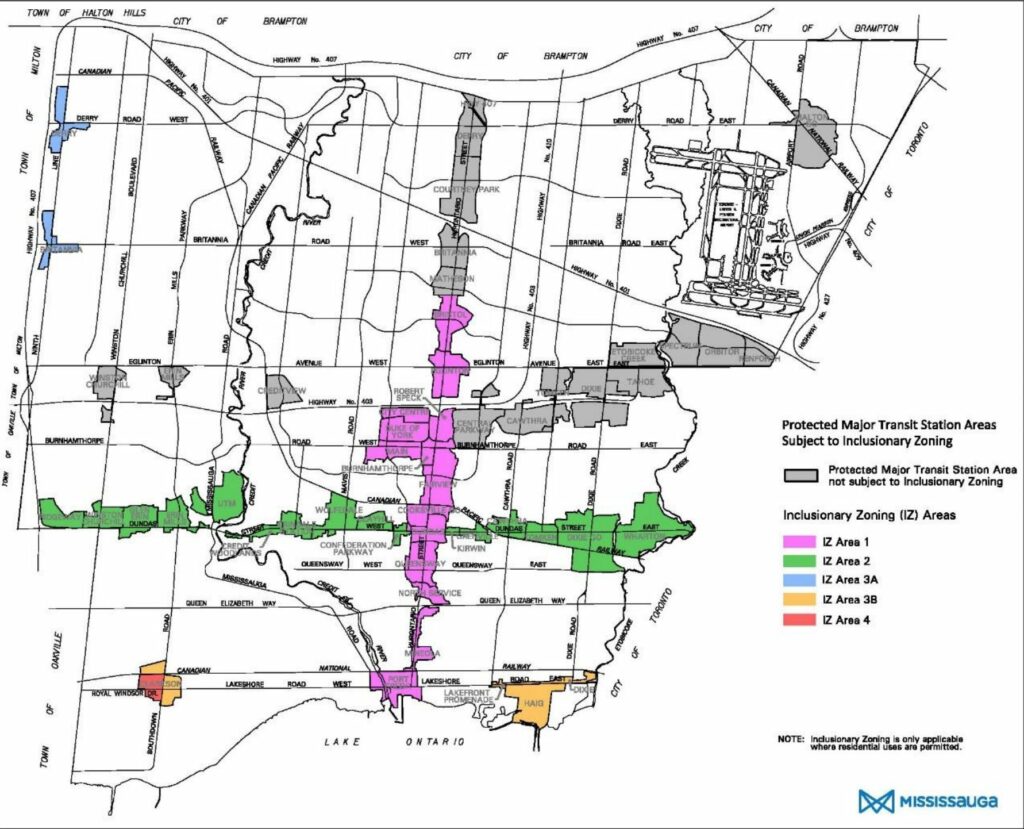

Anti-poverty advocates and building industry representatives alike doubt that the new rules, which were passed by council Aug. 10 and mandate creation of affordable units in developments near significant transit stations, will have the intended result of generating additional rental and ownership units below market price.

Tanya Burkart, from anti-poverty group Peel Acorn, says aspects of the city’s inclusionary zoning rules, including excluding purpose-built rental buildings and having lower mandates for the number of affordable units than other jurisdictions, make it a “weak policy.”

The rules apply to new developments with over 50 units in most areas of the city deemed major transit station areas, often referred to as MTSAs, where a significant public transportation hub exists such as a Hazel McCallion Light Rail Transit stop.

Mandates for the number of affordable units per development vary throughout the city in the policy, with around 10 per cent being the highest for ownership and five per cent for rental.

Burkart says the percentage of affordable units in the policy should be around 15 to 21 per cent to make an impact.

She also says the timelines for the program, which will see the affordability term for rental units phased out after 25 years, could mean homelessness for tenants suddenly spat out into the market.

“I think (the program is) about profit and it’s about what developers want versus what people need,” Burkhart says.

Richard Lyall, president of builders association Residential Construction Council of Ontario, also has doubts that the city’s inclusionary zoning policy will help boost affordability in Mississauga.

He says the policy, which is slated to come into effect in 2023, will add additional costs to buyers and amid escalating inflation, materials and labour costs could be “the straw that breaks the camel’s back” for builders trying to make projects feasible.

“It’s just not going to work,” Lyall says. “And, you know, in theory, it’s a nice idea, but the way they’ve set it up is just set up for failure.”

Mississauga’s inclusionary zoning policy follows Toronto passing similar rules in 2021 that are coming into effect this September. Other major cities including Montreal, Vancouver and New York are also using forms of inclusionary zoning.

Mississauga city staff identified inclusionary zoning as a “key action” toward improving affordability for middle-income households in 2017.

Ward 7 Coun. Dipika Damerla says that the city is working within the framework provided by the province and that staff made a plan trying to balance the interests of many parties, including developers and residents.

She says the policy is one tool the city has to address housing affordability and is hopeful that the new inclusionary zoning rules will lead more units below market price.

“We’re at zero now and whatever we do, whether perfect or imperfect, if it gets us to more than that, then we are further ahead than we were yesterday,” she says.

The inclusionary zoning rules come after years of escalating home and rental costs in Mississauga and the rest of the GTA, with many commentators pointing to low housing supply as a major cause of the spike.

According to findings from the Smart Prosperity Institute, Ontario needs 1.5 million new homes over the next 10 years to meet demand projected population growth.

The report says Peel Region will need 277,000 new homes by 2031, the highest of any municipality in Ontario and thousands more than the projected requirements for Toronto, York and Ottawa.

STORY BEHIND THE STORY: When we learned there was concerns about how Mississauga had set up its inclusionary zoning rules, we wanted to speak with stakeholders to learn how the policy may or may not impact housing affordability.