The Chronicle Herald: Protesters demand ‘more equitable housing’ in Halifax and beyond

Posted May 7, 2021

Posted May 7, 2021

A little over a year ago, Aidan Tompkins says the rent on his Halifax apartment increased by 29 per cent.

Ever since, he’s had to pick and choose what to spend his money on each month — a reality he said many tenants in the city are facing.

“There’s a bunch of things I don’t put in my budget in the first place because I expect to be gauged because there are other retailers and developers in other industries that play the same games,” Tompkins, treasurer for ACORN’s Halifax-Peninsula chapter, told The Chronicle Herald.

As a tenant, Tompkins said he feels “exploited, sold short, underappreciated and walked on.”

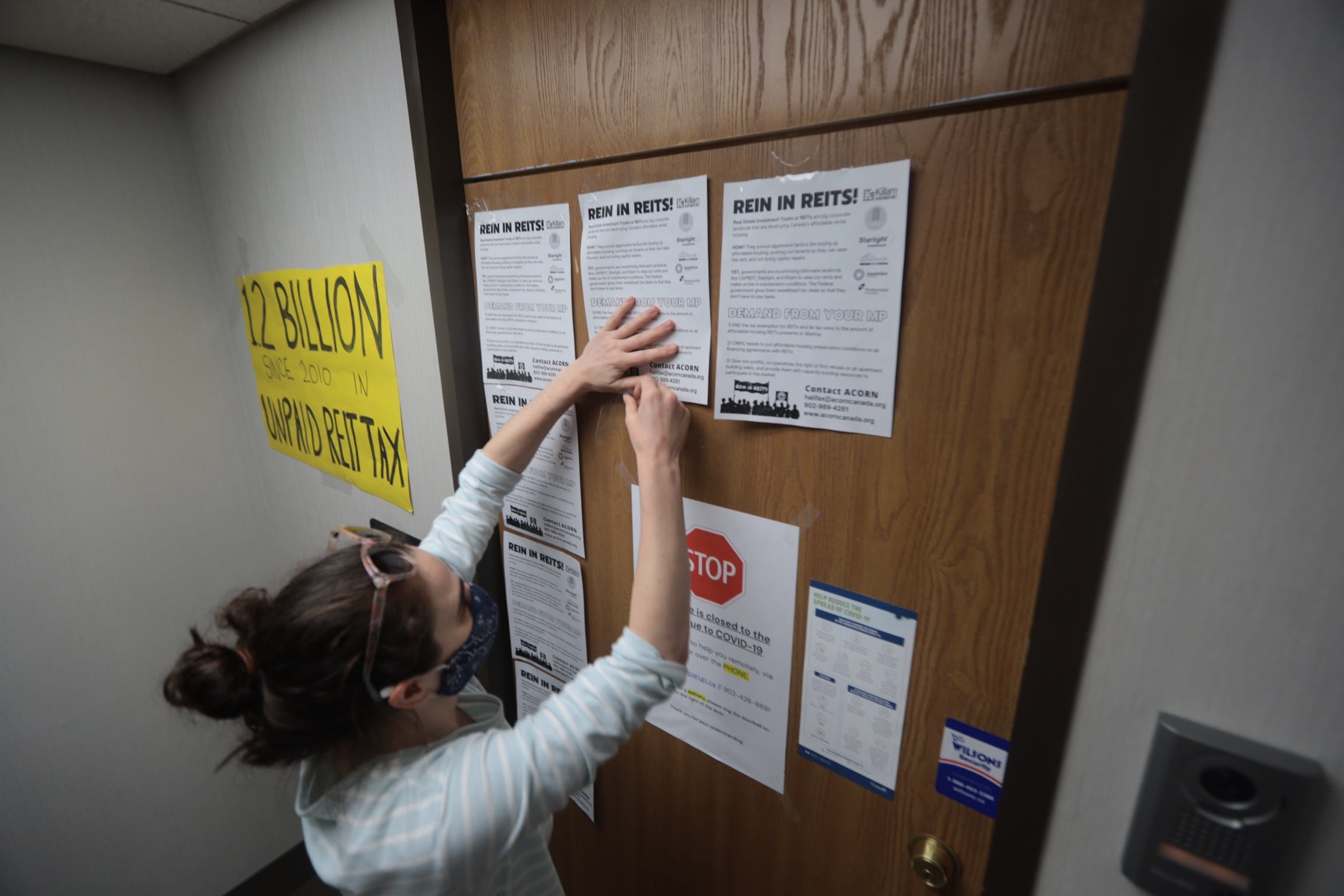

On Tuesday, he was among a group of people who were picketing outside of Halifax MP Andy Fillmore’s office to call on the federal government to “rein in” corporate landlords as part of ACORN Canada’s national “Rein in the REITs” campaign.

On Tuesday, he was among a group of people who were picketing outside of Halifax MP Andy Fillmore’s office to call on the federal government to “rein in” corporate landlords as part of ACORN Canada’s national “Rein in the REITs” campaign.

To make their demands known, the protesting ACORN members delivered a letter to Fillmore and held signs that read things like “A house is not a home when it is a commodity.”

According to ACORN Canada, housing is increasingly becoming a commodity and one of the main factors leading to the commodification of housing is the rapid growth of real estate investment trusts (REITs).

REITs are companies that own, and in most cases operate, income-producing real estate.

“A house is not a home when it is a commodity,” one Nova Scotia ACORN member’s sign reads. pic.twitter.com/m2poH8AqiS

— Noushin Ziafati (@nziafati) May 4, 2021

ACORN Canada states that in its recent research study, it found that REITs are getting preferential tax treatment by the federal government, which is what’s creating and fuelling existing affordable housing crises in cities like Halifax.

The multi-issue, membership based community union states that analysis of seven residential REITS showed that if they were taxed at the same rate as non-REIT Canadian corporations, they would have paid more than $1.2 billion more in taxes since 2010.

Sam Hall, a Nova Scotia ACORN member, said that amount of money could go a long way.

“In the middle of a pandemic and a housing crisis, I think we can all think of somewhere better that money could be than back in the pockets of companies who don’t take care of their properties, are trying to kick out low-income people and are contributing to some of our biggest crises,” Hall said.

The ACORN Canada study also states that each year the federal government’s National Co-Investment Fund builds 6,000 affordable housing units while CAPREIT alone flips roughly 14,000 “to get the maximum rent possible, pulling them out of more affordable priced units.”

“So our government is subsidizing affordable housing while incentivizing the destruction of that housing at the same time, which obviously doesn’t make sense,” Hall said.

Among other things, ACORN Canada is calling on the federal government to immediately end the tax exemption on REITs and implement a system where the taxes paid by REITs are directly related to the amount of affordable housing REITs are providing or eliminating.

The group is also demanding that the government bans REITs from owning certain types of multi-family residential buildings that are “best suited for permanent and true affordable housing” provided by non-profits.

The group is also demanding that the government bans REITs from owning certain types of multi-family residential buildings that are “best suited for permanent and true affordable housing” provided by non-profits.

“We’re here asking today to end the incentives to these companies and the tax loopholes for these companies and moving towards structures that can help non-profits, co-ops and more equitable housing structures actually take place and succeed,” Hall said.

The Chronicle Herald reached out to Fillmore for an interview, but did not receive a response prior to publication.

***

Article by Noushin Ziafati for the Chronicle Herald