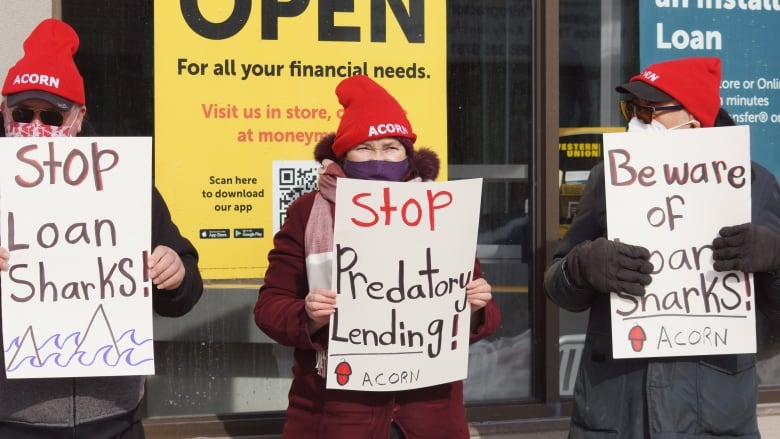

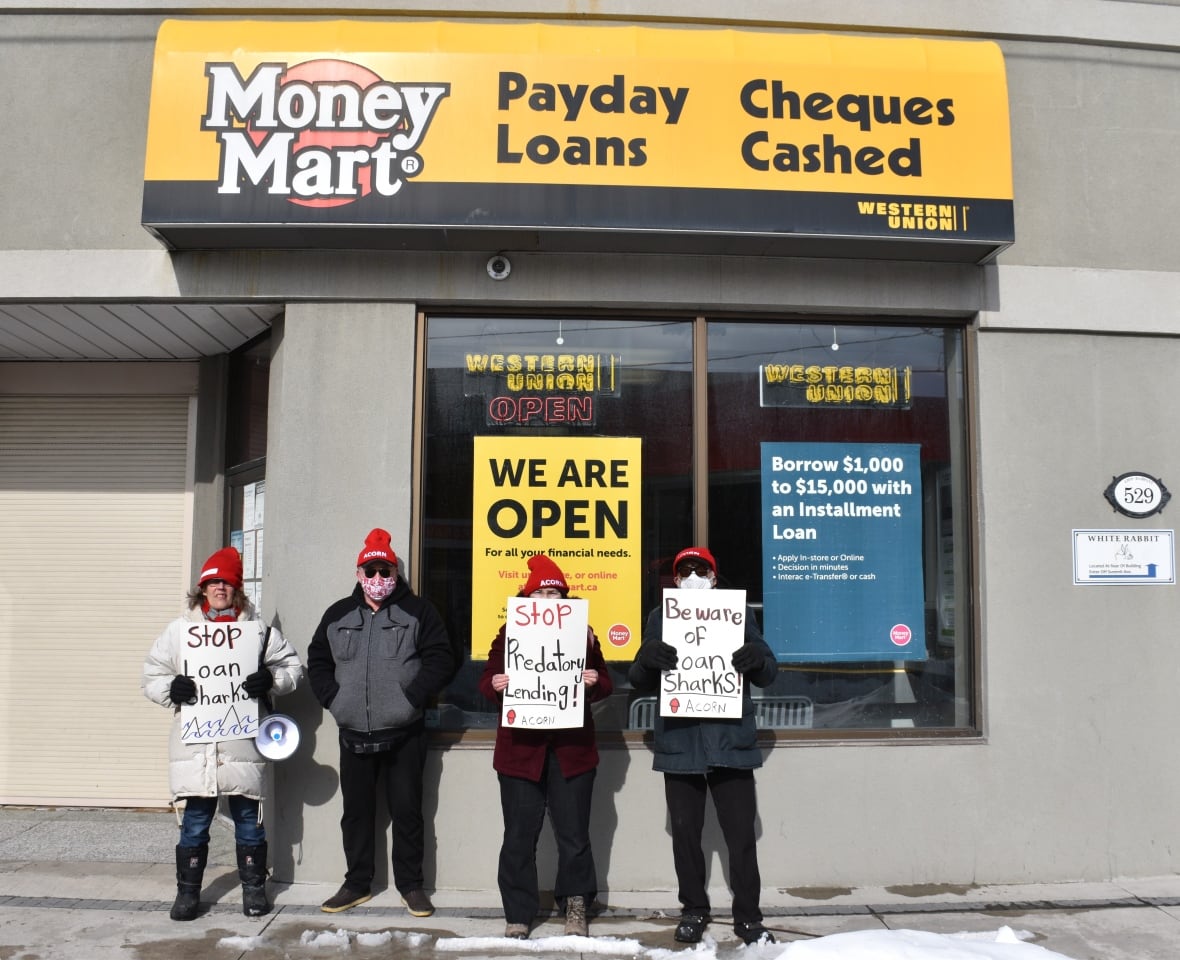

CBC News: Hamilton ACORN leaders target predatory lenders to demand lower interest rates

Posted February 20, 2021

The group delivered demands to Money Mart and Cash ‘N’ Cheque on Concession Street

Posted February 20, 2021

Hamilton ACORN leaders delivered a demand letter this week two of the payday loan stores on Concession Street — Money Mart and Cash ‘N’ Cheque — as part of efforts aimed at targeting predatory lenders to demand lower interest rates.

Hamilton ACORN leaders delivered a demand letter this week two of the payday loan stores on Concession Street — Money Mart and Cash ‘N’ Cheque — as part of efforts aimed at targeting predatory lenders to demand lower interest rates.

Wednesday’s action coincided with the release of results from a nationwide survey and report to understand the experiences of consumers of high interest loans — with interest rates from 25 per cent to 500 per cent or higher — especially when they are taken out online.

The ACORN leaders say that on Concession Street, there are currently no mainstream banks, leaving some low income people with few options nearby.

David Galvin, member of Hamilton ACORN’s downtown chapter, says he has been forced to turn to payday loan companies over the years because commercial banks have consistently denied his applications.

“Right now I actually have a term loan from Money Mart, which is at a very high rate of interest; I think it’s 47 or 49 per cent,” he told CBC News.

“I had one about three years ago, which was actually at a lower interest rate, and then it got refinanced and … it was at a higher rate when I refinanced about a year ago.

“It’s not a huge amount of money. It’s like $5,000, but over four years, it’s close to $300 a month to pay it back. My credit score is actually just as high as it was when I got the 27 per cent interest, but I guess they like to keep me on the hook with this one and they are not going to lower it,” he said.

Galvin, 68, who “had a serious gambling problem” and “went bankrupt quite a number of years back,” says he hopes to pay off the loan within the next year.

He said he recently applied for a loan at a commercial bank to cover his debts and was turned down.

“I’m an older person, I get CPP [Canada Pension Plan] and OAS [Old Age Security] and I actually work 40 hours a week as a security guard for $15 an hour, so I’m doing better than a lot of people that are low income. But these debts that’s I’m still paying back, including credit card debts that I still had from gambling, that’s high too. That’s like 29 per cent.”

“I promised myself I was going to pay these no matter what and here I am struggling to do it. Even working as I am and getting pension, it’s going to take a couple years to have everything paid.”

Mixed opinions about payday lenders

Galvin said while it is true that payday lenders are predatory, they are a stop of last resort.

“There are times when I wouldn’t have been able to buy food for myself had I not been able to go to a payday lender,” he said.

“So, I have somewhat mixed opinions about them. I just wish the interest rates were not that high, and they should be lowered.

Caught in vicious cycle of debt

Caught in vicious cycle of debt

Lisa Hind, a member of Hamilton ACORN’s Mountain chapter, says people take out these loans only once and they are caught in a vicious cycle of debt, which only spirals downward for them.

Hind said payday loan businesses are set up to cause people to fail and to keep paying more and more interest.

“They rake in the interest while these people struggle and suffer financially when they are already in a financial bind,” Hind told CBC News.

“Eighty per cent of the respondents say they took out a loan to meet everyday expenses such as rent, groceries and hydro.

“When people have to take out a loan to pay for rent and groceries, there’s seriously something wrong with the government system,” she said.

Hind said rents in Hamilton are starting at around $1,200 a month for a one-bedroom apartment and most people on limited income, the Ontario Disability Support Program, Ontario Works or CPP cannot afford that.

“So they go to these payday loan businesses to take out a loan to pay for the rent. These people are living on the edge of getting kicked on the street,” Hind said.

“If people have to go to the food bank to pay for groceries, [there are] serious problems with the system and the government needs to step up.”

Meanwhile, ACORN Canada has called on the federal government to mandate banks to create a national multi-jurisdictional anti-predatory lending strategy to protect low-income and other vulnerable consumers from predatory lending practices and enhance their access to fair banking options.

The survey, which garnered 376 responses, found a surge in the usage of instalment loans, as well as growth in high-interest online loans.

“What emerges clearly from this legislative scan and regulatory analysis is that there is a legislative incoherence with respect to high interest loans, which creates a range of issues for consumers availing such loans in Canada,” ACORN Canada said.

With respect to the payday loan industry, ACORN said several provinces have enacted legislation to ensure some bit of protection to people accessing payday loans.

In Hamilton, the city passed a bylaw in 2018 saying there could only be one payday loan establishment per ward, although existing places were allowed to stay. Since 2018, the number of licensed payday loan places has decreased by one.

ACORN Canada says several city governments continue to pass regulations offering stronger protections to people who have no choice but to rely on high interest loans.

“However, the situation with respect to instalment loans continues to be grim as the lenders can legally charge 60 per cent interest,” it said.

“The fact that these loans are not small dollar loans and constitute a growing market in Canada, calls for much stronger regulations.”

With respect to online loans in particular, the study finds that while many provinces make reference to loans taken on the internet, or remote loans, these regulations primarily pertain to payday loans.

Provinces such as Manitoba stand out, as Manitoba makes explicit reference to high interest loans, not restricting to payday loans, taken online.

The survey, which was administered in both official languages, captures responses from six provinces including Alberta, Manitoba, Nova Scotia, Quebec, Ontario and B.C.

***

Article by Desmond Brown for CBC News