ACORN members call on feds to criminalize high interest!

Posted December 15, 2021

Posted on December 15, 2021

ACORN members did a National Day of Action calling on the feds to criminalize high interest. ACORN has championed the fair banking campaign. ACORN’s recent Study on High Interest Loans shows that there has been a 300% increase in installment loan borrowing between 2016 and 2020 and their growth continues unabated. Lenders are allowed to charge 60% annual rate of interest on installment loans plus insurance, fees and others.

ACORN members did a National Day of Action calling on the feds to criminalize high interest. ACORN has championed the fair banking campaign. ACORN’s recent Study on High Interest Loans shows that there has been a 300% increase in installment loan borrowing between 2016 and 2020 and their growth continues unabated. Lenders are allowed to charge 60% annual rate of interest on installment loans plus insurance, fees and others.

We got the federal government to commit to take action against predatory lenders. The Trudeau government announced in the Budget 2021 that a consultation will be launched to lower the criminal rate of interest. A similar commitment was made by the Liberals in their election platform 2021.

The actions that were held in 9 cities, call on the Liberal Government to follow through on its commitments.

You can still take action: In case you missed the action, you can still send out a letter to the Prime Minister, Finance Minister, Justice Minister and your MP. Click here

Members also released a set of testimonials that cover experiences of people who have taken out payday loans and installment loans. Click here to read the testimonials.

ACORN, alongwith the Public Interest Advocacy Centre and Momentum released a policy paper that lays out recommendations to revise the criminal interest in Canada. Click here to access the policy paper.

With the parliament back in action, ACORN is urging the federal government to:

- Lower the interest rate on installment loans from 60%-30%.

- Include all charges and fees associated with a loan in the interest rate.

- Create a federally funded Fair Credit Benefit so that all low-income people have access to low-cost credit options in case of emergency, and support postal banking in all cities.

- Lower the NSF fees from $45 to $10.

Here’s a quick summary of members in action:

MONCTON: NB ACORN held a successful action in Moncton today!! Despite the wind, we had 10 people come out (including some new members!) as well as appearances from 91.9 the Bend, the CBC and the Times & Transcript.

MONCTON: NB ACORN held a successful action in Moncton today!! Despite the wind, we had 10 people come out (including some new members!) as well as appearances from 91.9 the Bend, the CBC and the Times & Transcript.

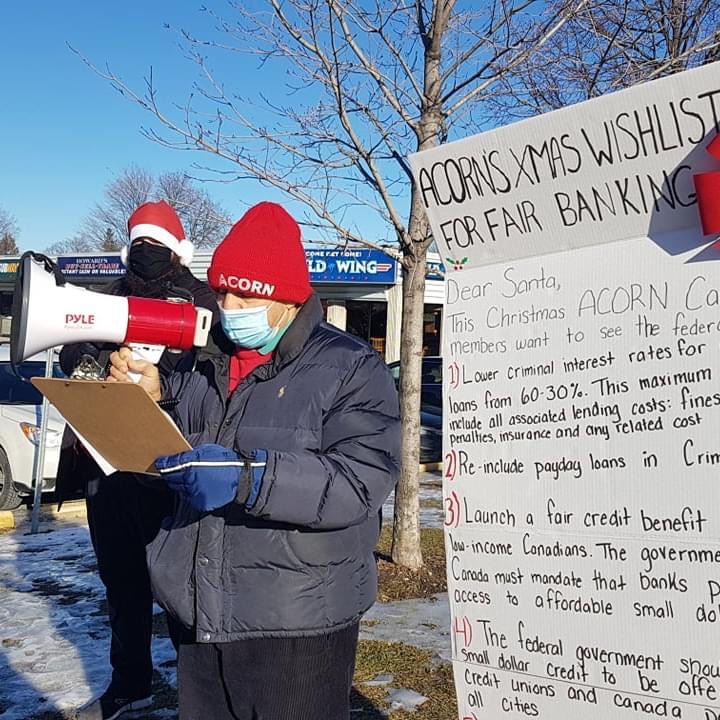

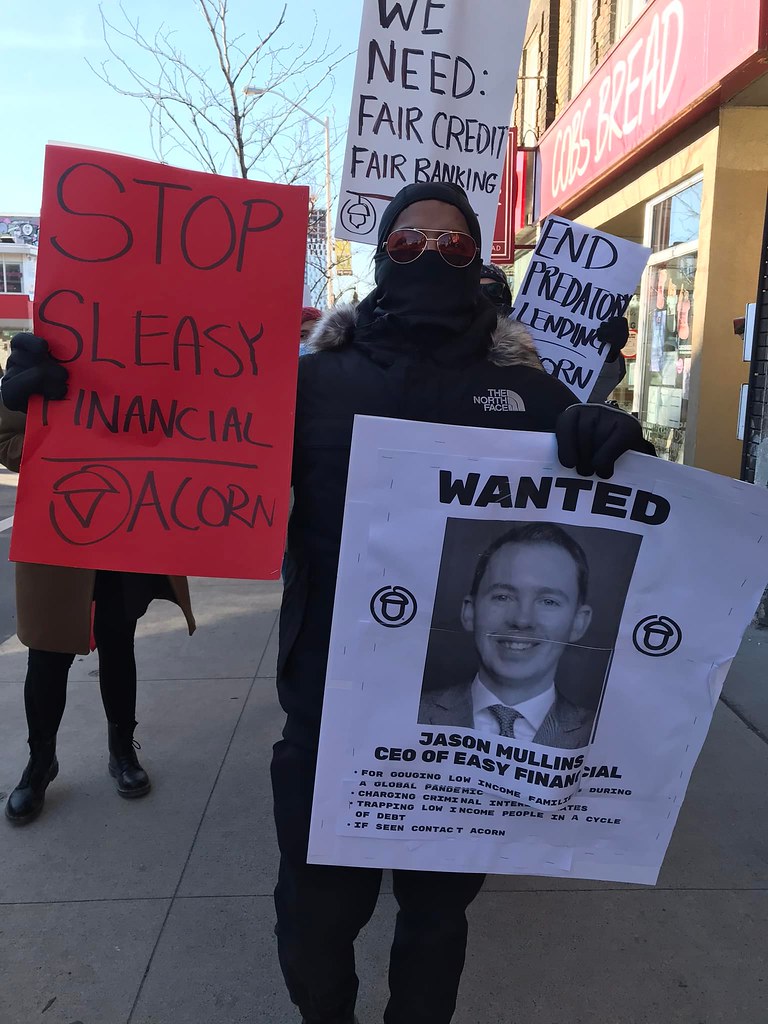

OTTAWA: Ottawa ACORN members really got into the holiday spirit for today’s action! 16 members presented their Christmas Wishlist for #FairBanking. One of our members, Eddy Roue, arrived as Santa and announced that Santa had no money for Christmas presents this year because he TOO had taken out an installment loan. Eddy as Santa then delivered empty Christmas boxes to other members before marching over to Easy Financial to deliver a letter and Grinch of the Year Award! We also heard from new member Aga Brezowski about her loan from Easy Financial – Sleazy Financial convinced her to add on a $500 bundled package that she didn’t realise until afterwards was completely optional. They also kept harassing her, calling her constantly to increase her loan and wouldn’t stop until she threatened to sue them!

deliver a letter and Grinch of the Year Award! We also heard from new member Aga Brezowski about her loan from Easy Financial – Sleazy Financial convinced her to add on a $500 bundled package that she didn’t realise until afterwards was completely optional. They also kept harassing her, calling her constantly to increase her loan and wouldn’t stop until she threatened to sue them!

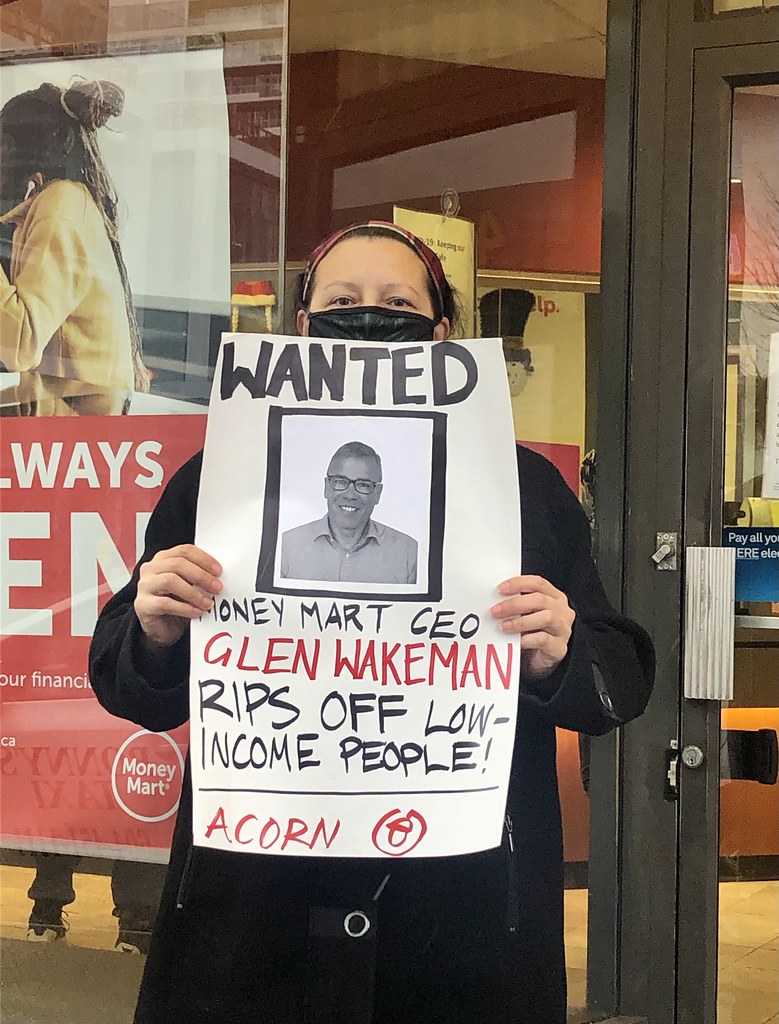

PEEL: Members came out for a Loan Shark Bank Crawl at Hurontario and Dundas – the corridor that has one of the highest concentrations of payday lender/instalment loan businesses, probably in the world! We got together at one of the Money Marts along Dundas where a member has taken out loans before and been gouged with insurance and other fees. The press showed up to interview our members there and from then we went onto about a dozen other shops that you can see the image with our letters and flyers. ACORN member Marcia led the action.

HAMILTON: Members met up in front of Money Mart, including allies from the USW Local 1005 union! It was awesome. Members Liz, Elizabeth, and Saush led the action with Liz, Elizabeth, Saush, and Marilyn giving speeches on why these issues are important to them, how these payday lenders have affected our community, and more! After going through our demands and campaign, we were led by the Stoney Creek chair Liz into Money Mart to drop the demand letter and do some chants! All the staff ran away but we were loud and had fun!

HAMILTON: Members met up in front of Money Mart, including allies from the USW Local 1005 union! It was awesome. Members Liz, Elizabeth, and Saush led the action with Liz, Elizabeth, Saush, and Marilyn giving speeches on why these issues are important to them, how these payday lenders have affected our community, and more! After going through our demands and campaign, we were led by the Stoney Creek chair Liz into Money Mart to drop the demand letter and do some chants! All the staff ran away but we were loud and had fun!

BC: Members called out on Money Mart that has ripping off low-and-moderate income people.

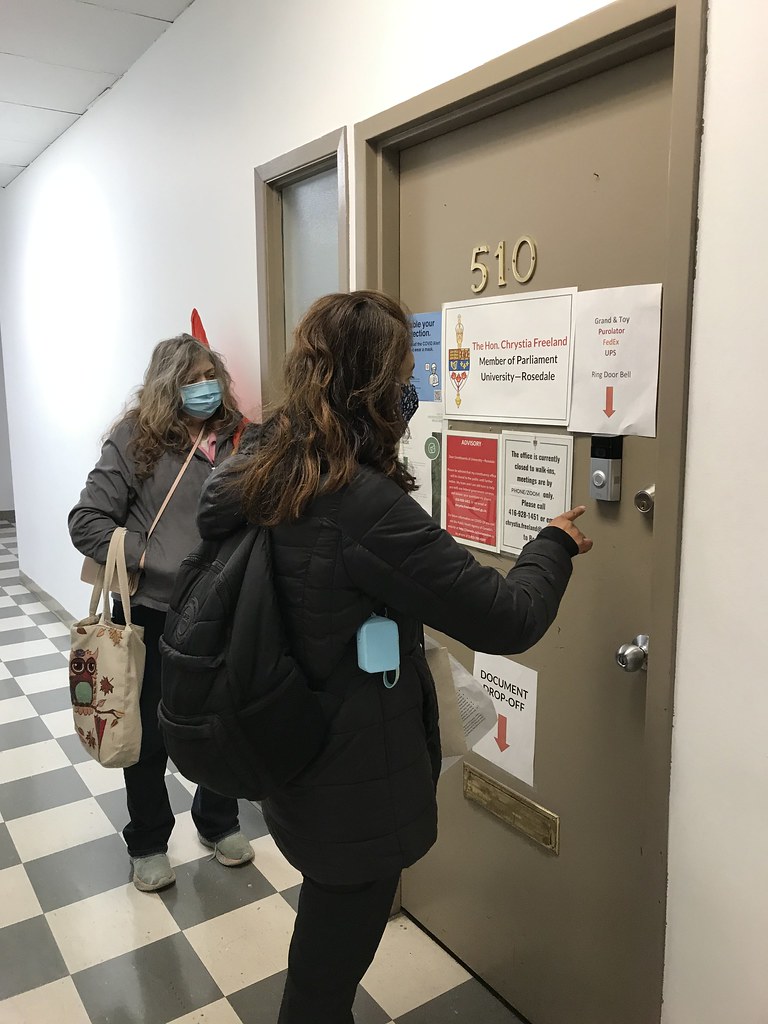

TORONTO: Members took over EasyFinancial and turned it into a ‘jail cell’ for trapping low-income families in a cycle of debt with their CRIMINAL interest rates. Members then marched to Finance Minister Chrystia Freeland’s office and spoke with her staff and delivered a copy of ACORN members’ testimonials. Shelly Ann spoke to Freeland’s staff about her own experience taking out a bad loan and how urgent it is that they do this consultation.

Actions were also held in Calgary and Halifax.

PRESS:

Insauga: Mississauga protest part of nationwide push to get Ottawa to make loans more affordable

CTV News Calgary: Calls to end predatory lending: ‘When somebody is drowning, you don’t throw them an anchor’

Jacobin: Despite Record Profits for Canada’s Big Banks, Customer Fees Keep Going Up

Hamilton Spectator: Hamilton ACORN protests high-interest loans

CHSJ 94.1: Group Protests ‘Predatory’ Payday Lenders

Capital Current: Ottawa anti-poverty group leads Vanier rally calling for government to ‘criminalize’ high-interest lending