Toronto Star Op-ed: For people who can least afford it, Ottawa needs to continue cracking down on predatory lending

Posted July 4, 2024

The cost of living is high and the recent federal budget aims to address the issue by taking certain measures.

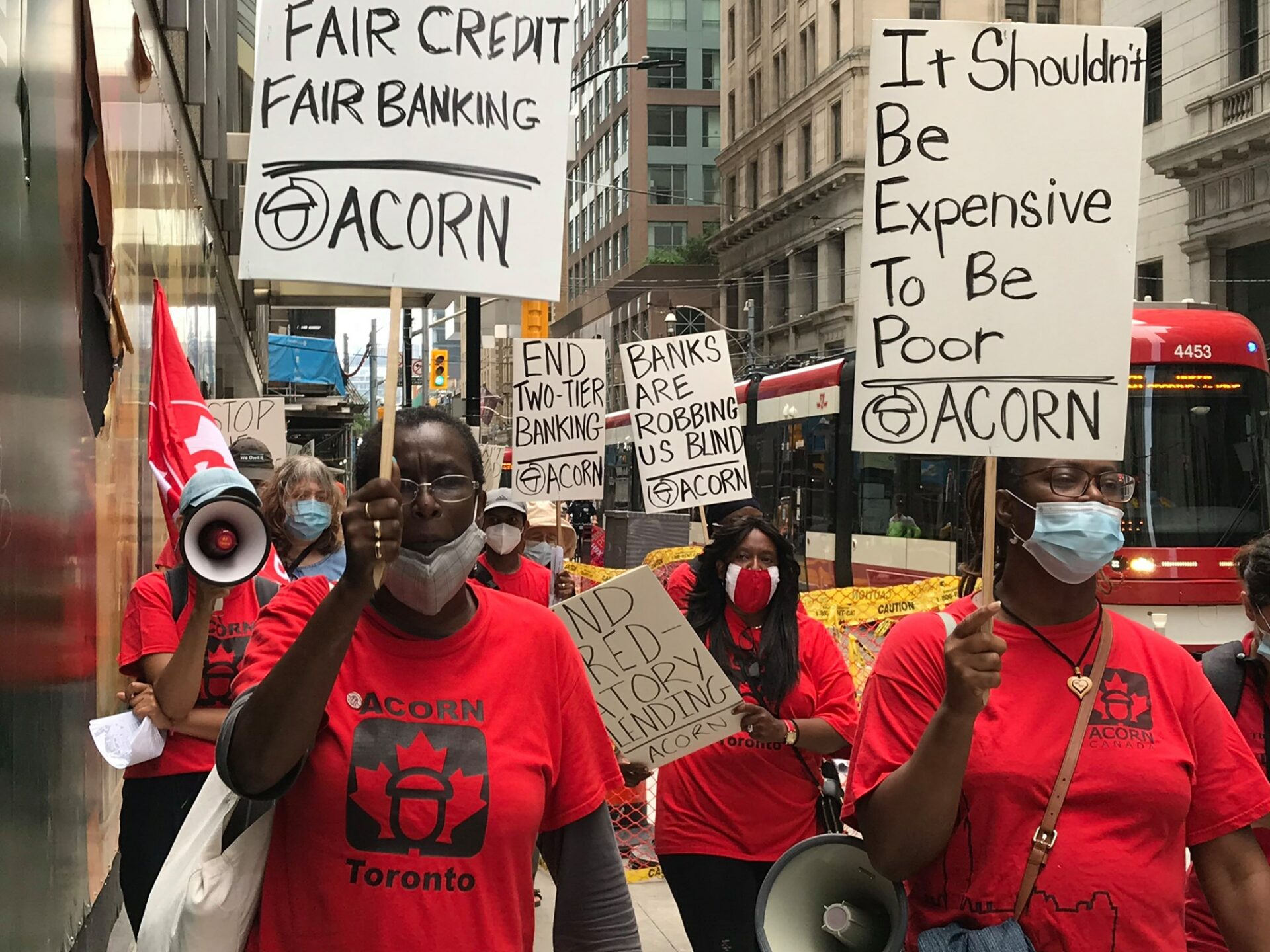

Lowering banks’ non-sufficient fund (NSF) fee to $10 from $48 is a huge step forward — a long standing demand of ACORN Canada, a national community union of low- and moderate-income people. The NSF fee hurts those that can afford it least, pushing many to payday lenders to avoid the fee.

Expanding the eligibility of no-fee accounts to more people is also a positive move.

One of the key aspects that affects low- and moderate-income Canadians is their lack of access to fair credit which drives many of them to high-interest loans which can become nearly impossible to pay off. Surveys by ACORN of low- and moderate-income people show the harmful consequences of these high-cost loans.

The Criminal Code makes it an offence to receive interest at a rate exceeding 60 per cent. High-cost instalment loans include loans with a fixed sum to be repaid with interest in installments over a period of time. And according to the government, an advertised interest rate of 48 per cent, annualized percentage rate (APR), works out to a 60 per cent effective annual rate. Lenders can then add on fees and insurance.

Recently, after years of advocacy by ACORN and its allies, Ottawa finalized the regulations that will amend the criminal code lowering the criminal rate of interest to 35 per cent from 48 per cent. The new regulation comes into force Jan. 1, 2025.

To further crackdown on predatory lending, the government also announced positive measures such as strengthening enforcement of the criminal rate of interest so people can prosecute companies without approval of the Attorney General — a major bottleneck faced by people who want to take lenders to court. It also mentioned capping the cost for optional insurance products.

A campaign by the Non-Prime Members of the Canadian Lenders Association says that lowering the interest rate cap will wipe out alternative lenders and that it will lead to illegal lending and a rise in criminal activity. But alternative lenders aren’t going out of business by any means.

Go Easy is one of Canada’s leading nonprime consumer lenders and offers high-cost instalment loans through one of its brands, Easy Financial. Aside from massive growth reported in its financial statements for 2023, in a press release in February, the company states “the periods of 2024 and 2025 have been updated to reflect the most recent outlook and assume that the previously announced new legislation to reduce the maximum allowable rate of interest to an annual percentage rate of 35% becomes effective mid-year 2024.” It forecasts its operating margin to rise by 39 per cent in 2024, 40 per cent in 2025 and 41 per cent in 2026.

Moreover, Easy Financial sees Quebec as a growth market — the only province which already has a lower interest rate for instalment loans.

South of the border, a report by the U.S. National Consumer Law Center shows that 42 states and the District of Columbia cap interest rates and fees on a $10,000 loan with a median cap of 27 per cent APR.

It argues that even 27 per cent is high, especially for larger loans, and 20 states plus the District of Columbia impose lower rate caps on $10,000 loans.

There is no evidence that in places like the U.K., Quebec or California, introduction of stricter regulations or lower interest rates for these loans has led to a rise in illegal lending. Addressing illegal lending requires stricter enforcement and not letting fringe lenders continue to prey on vulnerable people.

Evidence from the U.S. shows that after interest rates for high-cost loans were lowered, in state after state, consumers were better off and found better ways to cope with financial challenges.

People need real changes. As the government moves ahead in implementing these measures, it would be important to include all associated costs such as insurance within the capped rate, lowering the interest rate further as well as creating a low-cost or no-interest fair credit options so that people don’t have to rely on high cost loans.

****

Op-ed by Donna Borden, co-chair of the Toronto East York Chapter of ACORN Canada, for Toronto Star.