CTV News: ‘Unintended consequences’: Interest rate cap means some Canadians could lose access to their credit

Posted January 22, 2024

Some Canadians who have turned to high-interest loans due to not qualifying for traditional credit could lose access to them as the government prepares to pass new laws targeting predatory lenders, according to the Canadian Lenders Association.

The federal government is planning to prohibit lenders from charging borrowers interest rates over 35 per cent as part of its proposed criminal interest rate regulations. The cap would be reduced from 47 per cent, and would be the first time in 44 years Ottawa changed the “criminal” rate of interest.

But the change could have “unintended consequences,” said Jason Mullins, vice chair of the Canadian Lenders Association (CLA) and president and CEO of Toronto’s consumer finance company goeasy Ltd. CLA represents over 300 lenders (except payday lenders). These companies serve small businesses as well as prime and non-prime Canadian consumers.

The proposed regulations target non-prime lenders, which serve borrowers with lower credit scores who are ineligible for traditional bank loans. The rules will affect most loans, such as credit cards, lines of credit and instalment loans. Payday loans under certain conditions won’t be affected. Payday loans are short-term loans with high fees and have their own provincial regulations, Mullins said. Non-prime lenders charge higher interest rates because of the greater chance the customer may default, he added.

Consequently, consumers may have no other choice than to turn to unregulated companies or payday loans, which the CLA says often costs more than six times the price of a loan from its member lenders. Payday lenders can charge interest rates as high as 600 per cent, according to the CLA.

Up to four million Canadians, or under half of the non-prime consumer market, could be affected, he added.

“Either they will no longer qualify for a loan, or they might not qualify for the amount of credit that they need to deal with an everyday expense,” said Mullins in a phone interview with CTVNews.ca, noting the CLA has been sending letters to its clients about the proposed changes since last week.

“So the unintended consequences, if you take away the traditional loan from a licensed regulated lender … is just going to push people to the payday loans and create more illegal lending options, unfortunately.”

Studies by the CLA and other organizations found that significantly lowering the allowable interest rate creates a bigger illegal lending industry, Mullins said.

“They have attempted to make loans more affordable for Canadians thinking that that is good politics, but it’s an oversimplification to assume that those customers will all now just get a loan at a cheaper interest rate,” Mullins said.

Mullins describes non-prime borrowers as Canadians who work in various industries and earn an average income. Many are in their late thirties or early forties and have their own families. They typically don’t own a house and are still trying to build credit, Mullins said.

“The average customer that uses these non-prime products look very much like the average Canadian,” he said. “The only difference is that they have hit some sort of financial speedbump.”

New rules aim to protect Canadians

The government said it has committed to the measures to protect Canadians from predatory lending practices and is now reviewing the feedback from Canadians, businesses, consumer groups, and provincial and territorial regulators. It didn’t specify when it expects the new rules to take effect, though the CLA expects them to be implemented later this year.

“Predatory lenders can take advantage of the most vulnerable people in our communities, including low-income Canadians, newcomers, and seniors — often by extending very high interest rate loans,” said a Department of Finance official in an email to CTVNews.ca.

“That is why, to protect Canadians, we have lowered the criminal rate of interest from 47 to 35 per cent APR (annual percentage rate or cost of the loan), and adjusted the Criminal Code’s payday lending exemption to require payday lenders to charge no more than $14 per $100 borrowed, matching the lowest provincial rate in Canada.”

‘Why did you allow people to get exploited?’

Andreas Park, professor of finance in the Department of Management at the University of Toronto at Mississauga, calls the government’s policy “utterly lazy.”

He questions whether the government has data to show the extent of the problem with predatory lending. He said he feels the government is “shooting into the dark by going for another Instagram-able announcement.”

Park also wonders why the government is only acting now. “Why did you allow people to get exploited?” he said in an email to CTVNews.ca. “Interest rates have gone up, sure, but why were you ok with 47 per cent before?”

Park outlined two scenarios in which the policy can harm or benefit people. In the first case, he said it can hurt borrowers if the market is competitive and high rates reflect the lenders’ risk. As a result, people could lose access to credit.

In the second case, he said the cap can help people if the high-interest lenders have market power and it’s not a competitive market so they can charge “excessive” rates.

Advocate ‘grateful’ for measures

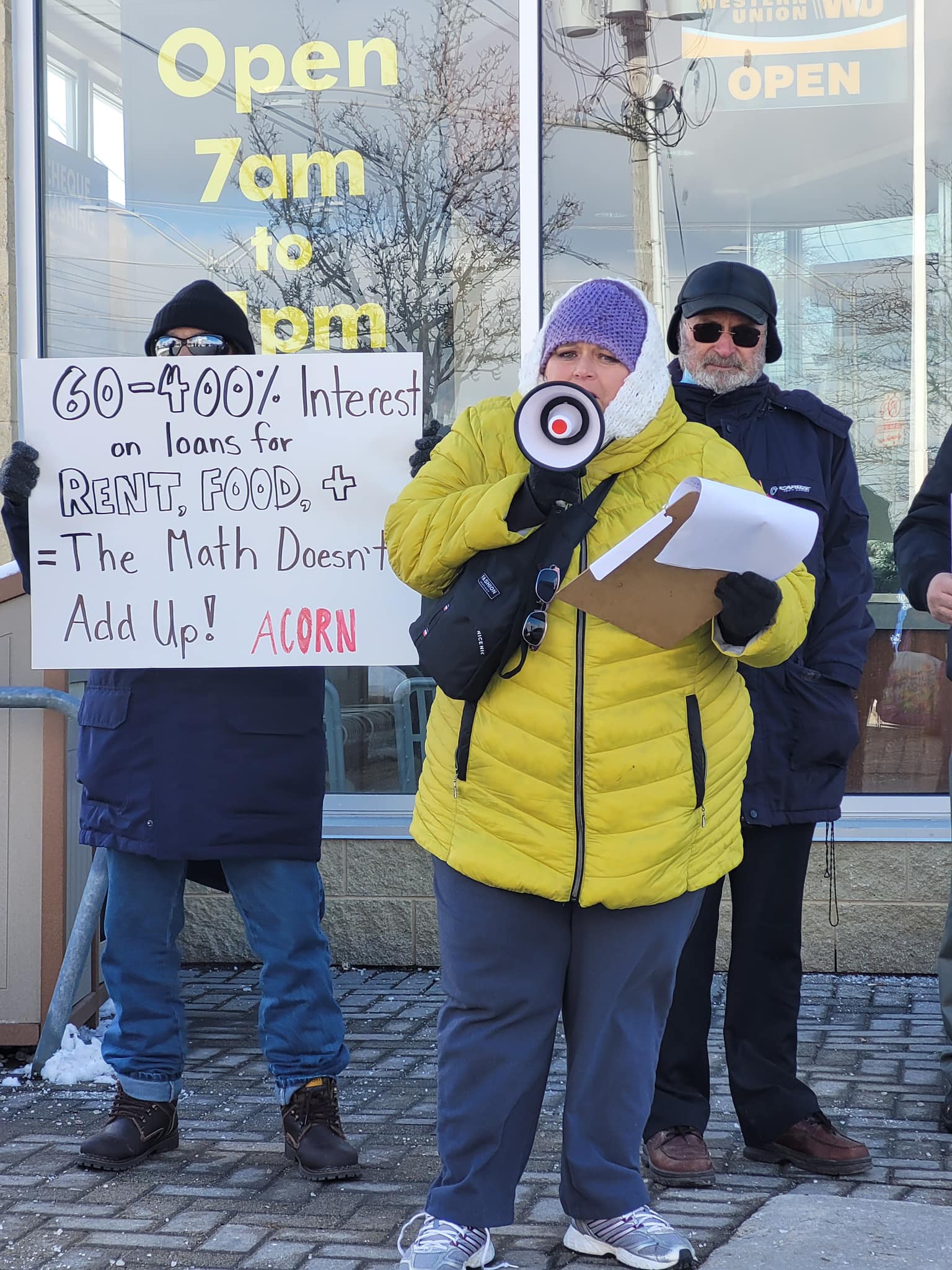

Marcia Bryan, an advocate with anti-poverty group ACORN Canada in Mississauga, Ont., calls the proposed law “a good move,” but she and her organization hope the government will lower the maximum allowable interest rate even more.

“I think it shows that they’re (the government) listening and they’re willing to do something,” she said in a phone interview with CTVNews.ca. “We’re happy and we’re grateful that they lowered it …. But we’d like to see it go lower.”

Additionally, Bryan would like to see a breakdown of the plan, including whether there are any hidden costs.

To prevent predatory lending, ACORN Canada recommends low-cost and small-value credit options to help Canadians with their finances. For instance, it said short-term small dollar-credit of $200 to $1,000 should be available to meet certain immediate needs such as paying the rent or buying groceries.

As another solution, ACORN Canada says a person’s access to credit should not be based on a credit score, which it believes is one of the reasons driving people to resort to “predatory loans.”

It also said the products shouldn’t be supplied by a financial entity focused on profits. Instead, the government, community development non-profit corporation, the banks’ non-commercial arm or a non-profit should supply those loans.

“People have no other choice. People are desperate,” Bryan said. “This is what happens because people are in a financial crunch. … you pay your rent, you can’t buy food. You buy food, you can’t pay your rent. So you’re trapped. What do you do?”

****

Article by Christl Dabu for CTV News